In my journey through the vast landscape of real estate investments, I’ve come to realize that few opportunities captivate and offer as much potential as pre-foreclosures.

These properties lie in a unique space: homeowners are behind on their mortgage payments, but their homes haven’t yet been claimed by the bank.

It’s a property in limbo

Pre-foreclosure once sounded uncertain to me, but now it signals prime investment opportunities.

Beyond the potential for a lucrative deal, diving into the world of pre-foreclosures has equipped me with insights to help homeowners during tough times, crafting solutions that benefit both of us.

In this blog post, I’ll share my insights on the undeniable significance of pre-foreclosures in the ever-evolving real estate market. Whether you’re a seasoned investor or just dipping your toes in.

I believe pre-foreclosures are a sector every real estate enthusiast should consider.

Table of Contents

Pre-Foreclosures: Definition & Buyer Opportunities

A pre-foreclosure refers to the status of a property when a homeowner has defaulted on their mortgage payments but before the lending institution has taken the property back and sold it at auction.

It’s the period after the lender has issued a notice of default but before the property goes to a foreclosure sale.

Why They Offer Valuable Opportunities For Buyers

I find there are four primary reasons why a pre-foreclosure is valuable for real estate investors

Below Market Value: When I’ve looked into properties in the pre-foreclosure phase, I’ve noticed that homeowners are often motivated to sell quickly to dodge foreclosure. Their urgency has sometimes allowed me to find properties priced below market value, letting me snag some excellent deals.

Negotiation Leverage: Recognizing the homeowner’s challenging position, I’ve found I often have a considerable advantage during negotiations. I’ve been able to discuss terms that are more favorable to me, like securing a lower down payment, getting reduced closing costs, or even brokering seller financing.

Less Competition: One of the things I appreciate about pre-foreclosures is that they aren’t typically as widely advertised as regular listings or bank-owned properties. This means that when I’ve done my homework and identified these opportunities, I’ve faced fewer competing offers than with traditional real estate listings.

Direct Interaction with Homeowners: Purchasing during the pre-foreclosure phase has allowed me to interact directly with homeowners. This direct communication has often made the transaction process more transparent for me. It’s given me a deeper understanding of the property’s backstory, its current state, and any lurking issues that I might need to address.

Find Pre-Foreclosure Listings

In my journey through the intricate realm of real estate, I’ve constantly been looking for opportunities that aren’t just profitable but also less explored.

That’s how I stumbled upon pre-foreclosures, a gold mine that many seem to overlook.

These unique listings, teetering on the edge of foreclosure, have offered me distinct advantages:

Especially when I knew where to look.

If you’re as eager as I was to dive into this niche, knowing how to find these pre-foreclosures is a game-changer. Join me as I share my insights on uncovering these hidden gems and crafting my own roadmap to real estate success.

Differences Between Regular Listings and Pre-Foreclosure Listings

In my experience navigating the real estate market, I’ve found that regular listings and pre-foreclosure listings are worlds apart.

Regular listings are straightforward; homeowners want to sell, and they list their properties at market-driven prices. However, pre-foreclosures are more nuanced.

These are homes where the owner is behind on mortgage payments and is on the brink of losing the property to the bank.

Often, these listings aren’t as public, and the selling prices can be notably below market value due to the urgency. Understanding these differences has been crucial in shaping my investment strategy and approach.

Platforms and Resources To Locate Pre-Foreclosure Listings

If you want to go the free route when finding pre-foreclosure properties, then usually a quick Google search will do the trick.

Navigating the internet has streamlined my process of accessing public foreclosure notices. With a swift Google search, I typically find what I need atop the results. For instance, in Virginia, the go-to website is:

Once there, it’s common to use filters, like city or notice date, to refine the search. Generally, the gap between a notice’s posting and the auction sale date ranges from two to four weeks, granting me ample time for property due diligence.

So, when you stumble upon a foreclosure notice, what should be on your radar? Admittedly, these notices can be wrapped in dense legal jargon, but here’s what I focus on:

Property Address: It’s typically nestled in the notice’s initial paragraph.

Auction Details: This includes the location, date, and time. Most foreclosure auctions take place at local municipal centers, usually outside courthouses. It’s crucial not to confuse the deed of trust date with the sale date; a quick skim can easily lead to mix-ups.

Representing Law Firm: This piece of information, though its placement can vary, is often toward the notice’s end. A quick tip? Check the law firm’s website; they often list sales, which can be invaluable for tracking rescheduled or canceled sale dates.

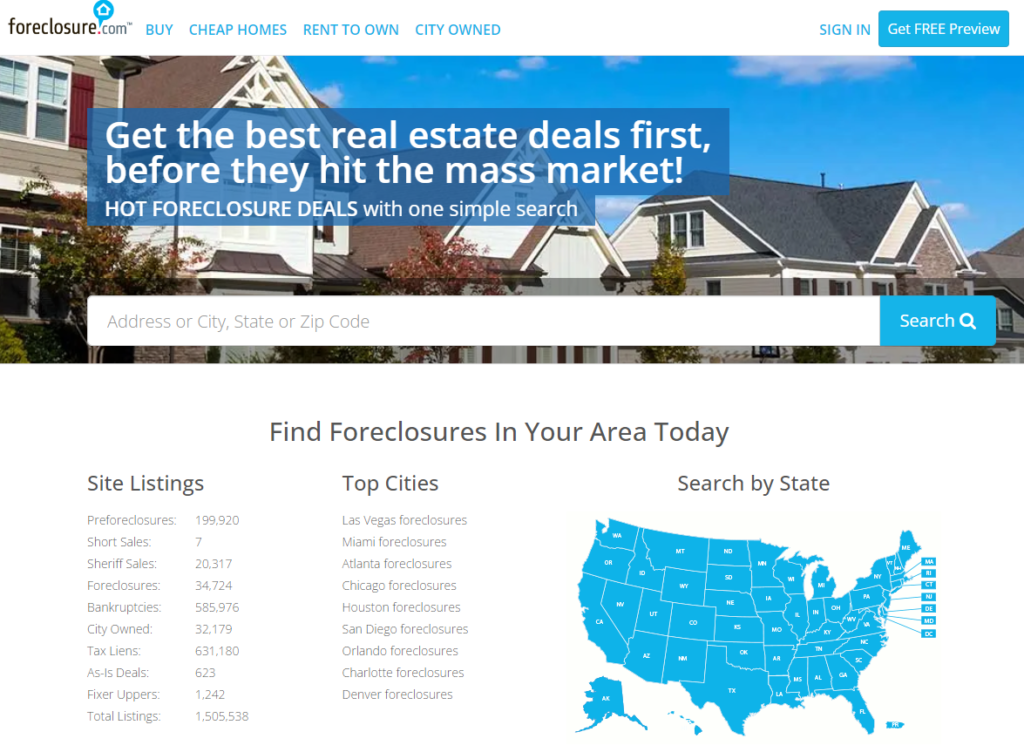

Another great website I recommend is:

This website gives you a way to find pre-foreclosure listings in your local area

The website also offers valuable tools such as:

Estimated Rental & Market Values

Foreclosure Status

Foreclosure Timeline

Property Information

Public Record

Tips On How To Effectively Use These Platforms

Search Filters: I utilize the search filters to narrow down the listings to meet my criteria, such as location, price range, and property type. You can do the same to find properties that match your preferences.

Save Searches: When I find searches or properties that pique my interest, I save them to revisit later easily. You might find this feature useful to access your favorite listings quickly.

Sign Up for Alerts: I sign up for email alerts to be notified when new properties that match my criteria are listed. It’s a good practice for you to stay updated on new listings too.

Check Regularly: Foreclosure listings can change frequently, so it’s a habit of mine to check back regularly for new listings. You’d be surprised at how the listings change from day to day.

Research: Before diving in, I thoroughly research any properties I am interested in. I look into the property’s history, the area it’s located in, and any potential issues or liens. This is something you should consider doing too to avoid any unforeseen problems.

Use a Map View: If available, I use a map view to get a better sense of the property’s location, nearby amenities, and other geographical considerations. It’s a feature you might find helpful in visualizing the area around the property.

Educate Yourself: It’s crucial to learn about the foreclosure process in your state and other relevant information to make informed decisions. As you read through this blog post, you’re taking a step in the right direction towards educating yourself too!

Pre-Foreclosure Listings – Benefits and Challenges

Navigating the realm of real estate investment, I often find myself drawn to the opportunities nestled within pre-foreclosure listings.

As someone striving to make smart, informed decisions, delving into pre-foreclosure listings opens a door to potential investments that you and I might otherwise overlook.

The allure of snagging a good deal and the chance to negotiate directly with the homeowner are compelling advantages. Yet, as with any venture, it’s not without its hurdles.

The path of pre-foreclosure investments invites both benefits and challenges, a duality that you and I must navigate to unearth the potential rewards waiting beneath the surface.

Pros Of Targeting Pre-Foreclosure Listings

Earlier, we mentioned the benefits of buying pre-foreclosures, such as:

Purchasing Below Market Rate

Gaining Negotiation Advantage

Encountering Fewer Competitors

Engaging Directly with Homeowners

Now lets look at the other side of the coin

Cons To Consider

Condition and Maintenance: The foreclosed properties you come across might be in poor condition due to neglect, vandalism, or lack of maintenance. This situation necessitates additional investment from me for repairs and renovations, something you might also encounter when delving into foreclosure listings.

Uncertain Property History: It may pose a challenge for you to obtain a complete history of repairs, renovations, and problems, which could lead to unexpected issues down the line. You may find yourself in a similar situation, facing uncertainties about a property’s past.

Emotional Toll: Dealing with foreclosures can be emotionally draining for you, especially when interacting with distressed homeowners. The emotional aspect of foreclosures is a reality you, too, might experience, adding a layer of complexity to the process.

Navigating the Pre Foreclosure Process

Diving into pre-foreclosures offers a unique real estate opportunity.

To maximize success, one must follow a structured approach. Let me guide you through the essential steps I’ve honed over time.

Steps Involved In Buying A Pre-Foreclosure

Educate Yourself: Familiarize yourself with the foreclosure process and the laws and regulations surrounding pre-foreclosures in your state.

Research Pre-Foreclosure Listings: Look for pre-foreclosure listings on real estate websites like Foreclosure.com or delve into city public records. There’s a plethora of information available to help you identify potential deals.

Contact the Homeowner: Reach out to the homeowner to express your interest. It’s important to be respectful and understanding of their situation, given the stressful circumstances they might be going through.

Perform Due Diligence: Once you locate a homeowner willing to sell their home before the sale date, begin your due diligence. This is why pulling the sale notice can be crucial, as it gives you an idea of how much time you have to buy the property before it forecloses.

Hire a Real Estate Agent: If you’re not confident in navigating a transaction yourself, consider hiring a real estate agent experienced in pre-foreclosures. Having professional guidance can make the process smoother.

Negotiate the Price and Terms: Negotiate a fair price and terms with the homeowner, ensuring all parties are clear on the agreement. It’s a delicate balance to strike, but with the right approach, a mutually beneficial agreement can be reached.

Secure Financing or Cash: Obtain pre-approval for a mortgage or secure other financing to ensure you can follow through with the purchase. Ensuring your finances are in order is a step I cannot stress enough, as it sets the foundation for a successful transaction.

Legal Considerations And Potential Pitfalls

Ensuring a clear title is paramount. Any liens or encumbrances on the title can throw a wrench in your purchase plans just as they did in mine. Delays or even a complete halt are possible if title issues arise.

Each state has its own set of foreclosure laws, and familiarizing yourself with the laws in your state can significantly impact your pre-foreclosure buying process. I learned the hard way that being unprepared can lead to costly mistakes.

Occupancy issues are another area to delve into. Determine whether the property is occupied and understand the legal implications and processes for possibly having to evict the current occupants.

Incomplete or inaccurate information about the property’s condition can affect its real value and the amount of repair work required. I’ve encountered situations where the disclosed information was far from the reality on the ground.

Homeowner bankruptcy is a curveball that can come your way. If the homeowner files for bankruptcy, it could halt the foreclosure process, affecting your purchase.

Legal fees are another consideration. Be prepared for potential legal fees that may arise, especially if complications occur during the transaction. I always set aside a contingency fund for unexpected legal expenses.

Proper documentation cannot be emphasized enough. Ensure all agreements and transactions are documented properly to avoid legal issues later.

Hidden costs such as unpaid taxes, utility bills, or homeowner association dues might also come knocking at your door, and being prepared for these is crucial.

Performing thorough due diligence is the linchpin of a successful pre-foreclosure purchase.

Understanding the financial and legal standing of the property will put you in a better position to negotiate and close the deal. Consulting with a real estate attorney who is familiar with pre-foreclosures has been a game-changer in my ventures and it’s something you might want to consider too.

Lastly, buying a pre-foreclosure comes with moral considerations. You are purchasing from individuals in financial distress. The emotional aspect of this process is something I grapple with, and it’s a reality that you too will need to face.

Tips For Successful Negotiation

In my journey through real estate investing, I’ve realized the goldmine that is the pre-foreclosure market, and it’s one avenue you don’t want to overlook.

When someone dives deep into this niche, they discover a landscape where homeowners are eager for solutions, and investors can offer them while securing potentially profitable deals.

For any investor, understanding this market isn’t just about capitalizing on opportunities; it’s about weaving a narrative where everyone involved finds a way out, turning potential losses into shared gains.