Get Rid of Mortgage Insurance Sooner Than You Think

Introduction One of the first things new homeowners notice is their payment feels way higher than what the lender originally quoted. I have seen this play out countless times. Someone buys a house, checks their first statement, and suddenly wonders why the mortgage insurance fee is taking such a big bite out of their payment. […]

Your Home Equity Might Be Costing You Money (Here’s Why)

Why Home Equity Ends Up Costing People Money Homeowners often overlook how their home equity can quietly work against them. The problem usually appears when Homeowners often overlook how their equity can quietly work against them. Many problems appear when people borrow without understanding their options. I have seen this happen to homeowners who thought […]

Mortgage Insurance Calculator for a Quick PMI Estimate

Home price Down payment percent or down payment amount Loan type Conventional with PMIFHA with MIP Credit score range 760 or higher720 to 759680 to 719640 to 679620 to 639Below 620 Calculate mortgage insurance Results Estimated loan amount – Loan to value – Estimated monthly mortgage insurance – Annual MI rate – Enter a home […]

When Does PMI Go Away? Here’s How to Speed It Up

The Truth About PMI If you bought your home with less than 20 percent down, you’re probably paying PMI and wondering when it finally goes away. It’s frustrating. You’re paying for insurance that protects the lender, not you. It feels like money slipping out of your pocket every month for nothing in return. The good news is PMI isn’t forever. Once you build enough equity in your […]

MIP vs PMI: The Difference That Saves You Thousands

The Hidden Cost That Trips Up New Homeowners You finally got pre approved for a mortgage and you are feeling good until your lender drops the term mortgage insurance. If you are like most first time buyers your first thought is probably something like “Wait… I already have homeowners insurance, why do I need this too.” That is where it gets tricky. There […]

How Much Does Mortgage Insurance Cost? Most Pay Too Much

The Hidden Cost No One Mentions You’ve finally found the right home. You’ve budgeted for the payment, taxes, and insurance. Then your lender sends over the final estimate, and there’s a charge you didn’t expect: mortgage insurance. It’s not homeowners insurance. It doesn’t protect you, it protects the lender. If you put less than 20 percent down, the bank adds it as a safeguard in case you default. So […]

Free Home Equity Calculator (See How Much Cash You Can Pull)

Home Equity Calculator Home Equity Calculator Zip code Estimated home value Estimated mortgage balance Credit score Excellent 750+ Good 700–749 Fair 640–699 Poor under 640 Calculate Most lenders cap combined LTV between 75 and 85 percent depending on credit profile Available equity — Current loan to value — Max loan at typical cap — Optional […]

How Does a Reverse Mortgage Work (The Real Truth Banks Hide)

The Truth Behind the Commercials You’ve seen those commercials, the ones with the smiling retirees sitting on a porch, talking about how they “got paid” by their house. It almost sounds too good to be true. Because, in a way, it is. A reverse mortgage isn’t free money. It’s not the bank doing you a favor out of the kindness […]

Mortgage Recast Explained (The Trick to Lower Your Payments)

The Secret Your Bank Won’t Tell You You’ve been paying that mortgage like a champ. Maybe even throwing extra cash at the principal just to feel that little hit of financial pride. Then one day, you stumble across something that makes you stop mid-scroll. There’s a way to lower your monthly mortgage payment… without refinancing. Wait… what? Most homeowners have […]

How to Use Home Equity to Build Wealth Faster Than You Think

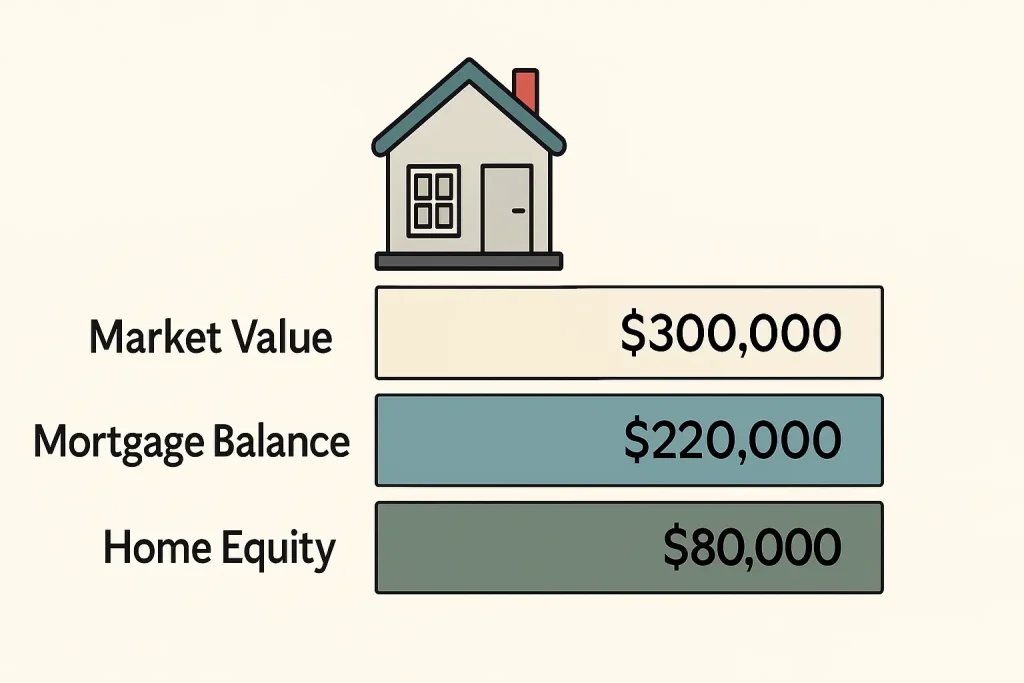

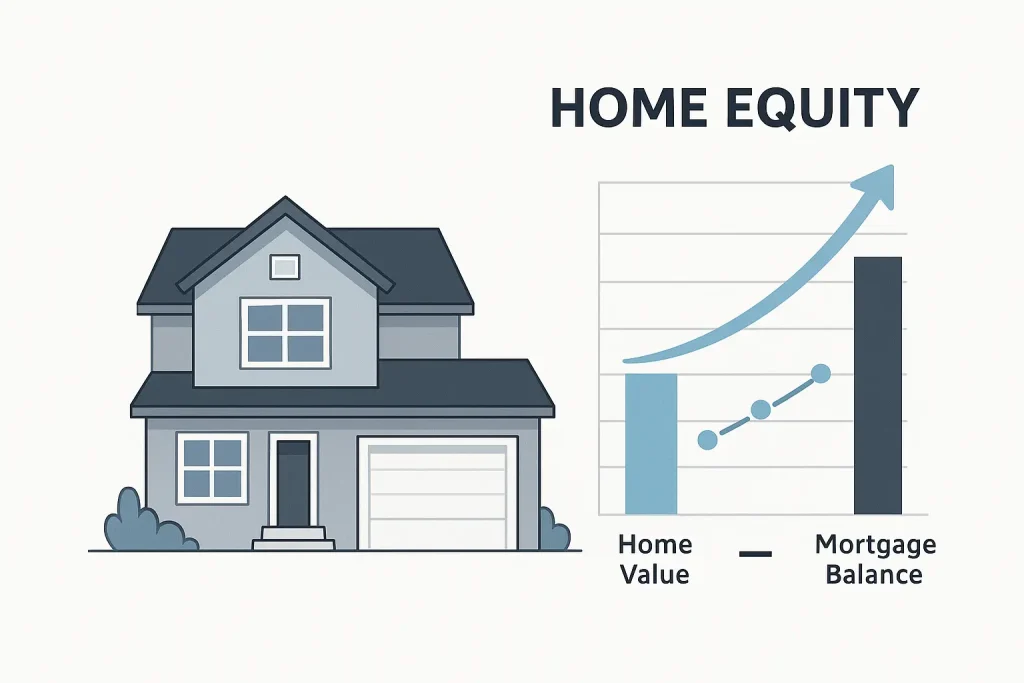

Most people think of their home as a place to live. A roof, a few walls, maybe a fenced backyard for the dog. But what they often miss is that it’s also a financial engine sitting quietly in the background, growing in value while they sleep. Home equity is simple. It’s the difference between what your home is worth and what […]