You ever catch yourself staring at your mortgage statement wondering, “Should I refinance my mortgage?”

If so, you’re not alone. Homeowners all across the country are asking that same question every time rates drop, or every time someone at work brags about lowering their payment by a few hundred bucks a month.

Refinancing can be a financial power move… or a massive waste of money. The truth is, it’s not a one-size-fits-all decision. It depends on your rate, how long you plan to stay in the home, and whether the savings actually outweigh the costs.

If you want the bigger picture of how tapping your home equity can help or hurt you, this post breaks down the tradeoffs in plain English.

This guide walks you through seven clear signs it’s finally worth it, or not. No lender jargon, no “refi hacks.” Just straight talk on when it makes sense, when it doesn’t, and how to tell if you’re about to make a smart money move or just hit reset on another 30 years of payments.

What Does It Really Mean to Refinance a Mortgage?

Let’s start with the basics, because most people don’t actually know what refinancing is.

Refinancing isn’t some fancy loan trick—it’s simply replacing your old mortgage with a new one. You’re basically hitting “restart” on your loan, ideally with a lower interest rate, better terms, or both.

Here’s how it usually works: your new lender pays off your existing mortgage, and you start fresh with a new loan—new rate, new payment, and new closing costs.

There are a few main types:

- Rate-and-Term Refinance: You keep roughly the same balance but change your interest rate or loan term (like switching from a 30-year to a 15-year).

- Cash-Out Refinance: You borrow more than you owe and pocket the difference as cash—often used for renovations, debt payoff, or home improvements.

- Streamline Refinance: Offered on FHA or VA loans to simplify the process with less paperwork and potentially no appraisal.

If you have an FHA loan and are paying mortgage insurance, refinancing can be a clever way to ditch those premiums. Once you’ve built at least 20% equity, you might be eligible to switch to a conventional loan and finally remove PMI for good.

Just keep in mind, refinancing isn’t free. You’ll usually pay 2% to 5% of your loan balance in closing costs—things like appraisal fees, title insurance, and lender origination charges. The key is to make sure your monthly savings justify those costs.

Before choosing a lender, the CFPB’s Loan Estimate tool walks you through how to compare offers and understand true loan costs.

So before you jump in, take a minute to understand what’s actually changing—and what it’ll cost you—because that’s what separates the people who save money from the ones who just restart their loan clock

Sign #1 – Interest Rates Dropped at Least 1% (and You Plan to Stay Put)

Here’s the truth: a lower interest rate doesn’t automatically mean refinancing makes sense. But when rates drop by about 1% or more, that’s when your ears should perk up.

Let’s say you bought your home a few years ago at 7%. Now rates hover around 6% or lower. That may not sound like much, but on a $350,000 mortgage, that’s roughly $230 less per month.

That’s real money.

And when you multiply that by 12 months, you’re looking at nearly $3,000 a year in potential savings. Over time, that kind of difference can help you build an emergency fund faster, pay off debt, or even knock a few years off your loan if you decide to refinance into a shorter term.

If you’re wondering whether now’s the time, you can check the latest average mortgage rates from Freddie Mac, they update them weekly so you can see how today’s numbers compare to when you first locked in your loan.

But here’s where most homeowners mess up: they forget about closing costs.

Refinancing usually costs 2% to 5% of your loan balance upfront, so you need to hit your “break-even point” before you actually start saving.

For example, if you’ll save $230 a month and the refinance costs you $6,000 to close, you’ll need to stay in the home at least 26 months before you truly come out ahead.

- If you know you’re staying put for a few more years, it’s worth running the math.

- If you’re planning to move or sell soon, refinancing might not make sense yet.

In short, the first sign that refinancing is worth it isn’t just that rates dropped—it’s that they dropped enough, and you plan to stay long enough to let those savings work for you.

(This is also where you can place your savings comparison graph — right below this section — to visually show how a 1% drop impacts monthly payments at different loan amounts.)

Sign #2 – Your Credit Score’s Gone Up Since You Bought

If your credit score has climbed since the day you closed on your home, congratulations—you’ve quietly earned yourself a better deal.

Here’s why that matters: your credit score is one of the biggest factors lenders use to determine your refinance rate. When you first bought, maybe you had a few dings on your report, a shorter credit history, or a higher debt-to-income ratio. Fast-forward a few years—you’ve paid down debt, kept your credit cards in check, and now your score’s looking a whole lot healthier.

That improvement can translate into tens of thousands of dollars in savings over the life of your loan. Even a jump from a 660 to a 740 credit score could lower your interest rate by half a percent—or sometimes more, depending on market conditions.

According to Experian, when comparing refinance options, “Most lenders require a credit score of at least 620, though a higher score can help you qualify for better rates.”

It’s also where a refinance can do double duty: not only can you score a better rate, but if you originally had an FHA loan with mortgage insurance, your stronger credit profile may qualify you to switch into a conventional loan and finally drop those PMI payments.

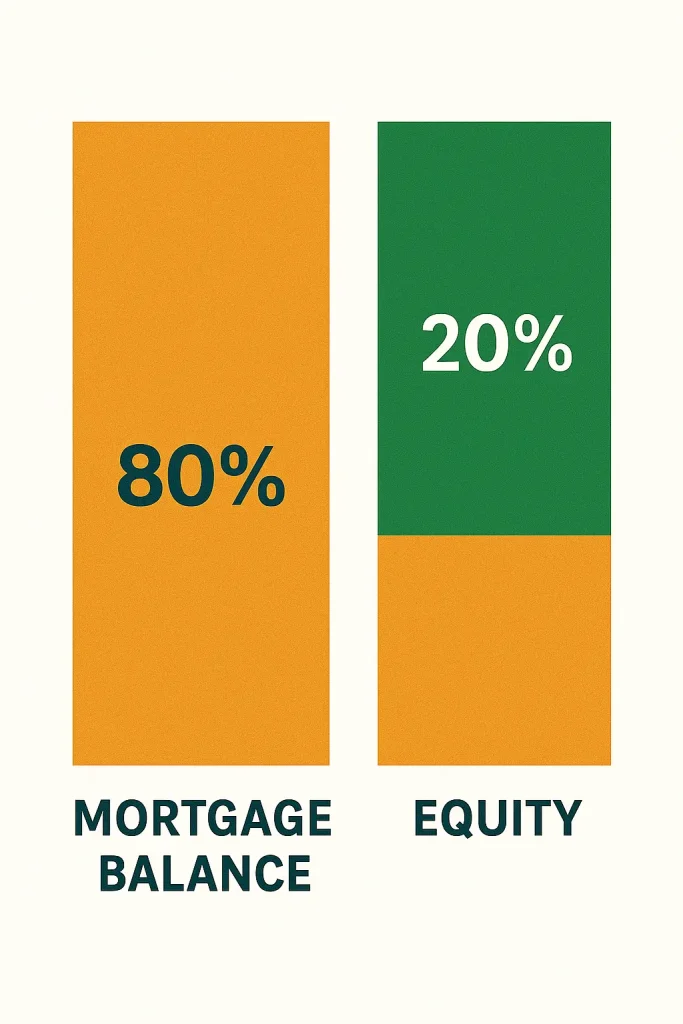

Sign #3 – You’ve Built 20% Equity (and Can Ditch PMI for Good)

If you’ve been paying your mortgage for a few years, there’s a quiet milestone that could save you hundreds every month—and most homeowners don’t even realize they’ve hit it.

It’s called the 20% equity mark.

Once you owe less than 80% of your home’s current value, you’ve officially crossed the line where lenders no longer require Private Mortgage Insurance (PMI) on most conventional loans. And that opens the door to one of the best reasons to refinance.

Here’s why this matters: PMI doesn’t benefit you. It protects the lender. You’re paying an extra $100–$300 a month, and for what? Nothing you get to keep. Refinancing into a new loan once you’ve built enough equity can eliminate that cost for good—and that savings alone can often justify the refinance.

Let’s say your home’s now worth $400,000 and you owe $320,000. That’s exactly 80% loan-to-value. If you refinance into a conventional loan, you can drop PMI entirely and instantly free up hundreds a month.

To confirm your home’s current value, you can use tools like the Penny Mac’s free home value estimator or even check recent neighborhood comps. A new appraisal during the refinance process will verify it officially.

According to Investopedia, most lenders automatically drop PMI when your balance reaches 78% of the home’s value—but refinancing is often the faster way to reach that milestone on your own terms.

So if you’ve built that 20% cushion, refinancing isn’t just about lowering your rate—it’s about stopping the slow leak that PMI has been draining from your monthly budget.

The bottom line? If you’ve improved your credit and built some equity, you’re no longer the same borrower you were when you bought your home. And that means you don’t have to keep paying the same rate as if you were.

Refinancing can be your reward for doing the hard work—just make sure the numbers still make sense before signing on the dotted line.

Sign #4 – You’re Switching From an Adjustable Rate to a Fixed Rate (and Want Peace of Mind)

If you bought your home with an adjustable-rate mortgage (ARM), you probably remember the sales pitch: “You’ll get a lower rate now, and you can always refinance later.”

Well, later might be right now.

Here’s the thing about ARMs—they start off looking like the smartest move in the room. The introductory rate is lower, which means smaller payments upfront. But after that fixed period ends (usually 3, 5, or 7 years), your rate begins to “float” with the market.

And when rates rise? So do your payments.

According to the Federal Reserve, an ARM can reset every six months after the initial period, meaning your payment could jump several hundred dollars practically overnight.

If you’re already nearing your first adjustment window—or just tired of playing interest-rate roulette—refinancing into a fixed-rate mortgage can give you something way more valuable than a temporary discount: peace of mind.

Let’s say you started with a 5/1 ARM at 4%. Now that your fixed period is ending and the market rate sits closer to 7%, your payment could surge by hundreds per month. Refinancing into a 30-year fixed, even at 6%, locks your payment for good.

That consistency matters. Especially if you’re budgeting for kids, retirement, or just don’t want your mortgage turning into a guessing game every few months.

Bottom line: refinancing out of an ARM isn’t about chasing the lowest rate—it’s about locking in stability. When the market’s unpredictable, certainty is a luxury that pays for itself.

Sign #5 – You Want to Shorten Your Loan Term Without Killing Your Budget

Most homeowners think of refinancing as a way to lower their monthly payment. But sometimes, the smartest move is the opposite — keeping your payment close to the same while cutting years off your loan.

If your income’s gone up or your budget’s stabilized, refinancing into a shorter term (like a 15-year mortgage) can help you pay off your home faster and save tens of thousands in interest.

Let’s look at an example:

| Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

| 30-Year Fixed | 7.00% | $2,161 | $415,560 |

| 15-Year Fixed | 6.25% | $2,956 | $129,080 |

That’s a $795 difference per month, but nearly $286,000 in lifetime interest savings.

If you can handle that bump in payment, the long-term payoff is massive. Plus, shorter-term loans often come with lower interest rates than 30-year mortgages, which makes the math even more appealing.

According to Nerd Wallet, “A shorter mortgage term … means you’ll build home equity faster and pay less interest over the life of the loan.”

The key is to make sure you’re not stretching yourself too thin. You want to be aggressive, not reckless.

If your goal is to build wealth faster and pay less in interest, refinancing to a shorter loan term might be the smartest move you can make—especially if rates have dropped or your financial situation has improved since you first bought your home.

Sign #6 – You Want to Tap Equity for Renovations or Debt Payoff (But With Caution)

This one’s tempting. You’ve been watching your home’s value climb, and you’ve probably thought, “Maybe I should refinance my mortgage and take some cash out.”

And sure — tapping into your home’s equity can be a smart move. But it can also backfire if you’re not careful.

Here’s how a cash-out refinance works: you replace your existing mortgage with a new, larger one and take the difference in cash. For example, if you owe $250,000 and refinance into a $300,000 loan, you pocket $50,000 at closing (minus fees).

Sounds nice, right? And it can be — when used for the right reasons.

✅ Good uses:

- Renovations that add long-term value to your home (kitchen remodels, roof replacement, adding square footage).

- Consolidating high-interest debt (credit cards, personal loans) into one lower-rate payment.

- Covering major life expenses that have a clear ROI, like education or medical costs.

🚫 Bad uses:

- Vacations, new cars, or “fun” purchases that don’t build value.

- Paying off debt only to run it right back up again.

- Extending your loan term so far that you end up paying more in interest overall.

According to Consumer Financial Protection Bureau (CFPB), cash-out refinances made up a growing share of all refinances during periods of rising interest rates, which implies more homeowners were tapping equity when market rates were increasing — a strategy that amplifies risk.

If you’re thinking about using your equity, start by asking one question: Will this move improve my financial position five years from now?

If the answer isn’t a confident yes, you might be better off leaving that equity untouched for now.

Refinancing should never be about “easy money.” It should be about strategic money — using what you’ve built to get ahead, not fall behind.

Sign #7 – You Plan to Keep the Home Long Enough to Break Even on Closing Costs

Here’s a question most homeowners skip when deciding should I refinance my mortgage:

How long until the savings actually outweigh the costs?

Because refinancing isn’t free. Between lender fees, title charges, appraisal costs, and closing expenses, most refinances run 2% to 5% of your loan balance. So if your balance is $350,000, expect to spend somewhere around $7,000 to $17,000 just to make the switch.

That’s where your break-even point comes in. It’s the moment when your monthly savings from refinancing finally catch up to what you paid to do it.

Here’s a quick example:

- You refinance and save $250 per month.

- Your total closing costs are $6,000.

- $6,000 ÷ $250 = 24 months.

In other words, if you plan to stay in your home for at least two more years, you’ll come out ahead. Move sooner than that, and you’ll probably lose money.

The Consumer Financial Protection Bureau (CFPB) explains that this “break-even test” is a simple way to figure out whether refinancing truly helps you or just resets your loan clock.

Likewise, Forbes Advisor points out that homeowners should always calculate their break-even timeline before refinancing—because what looks like a great deal on paper can turn into a financial loss if you sell too soon.

If you’re planning to stay put long enough to cross that break-even mark, refinancing can be a smart financial move. But if there’s a chance you’ll relocate, upgrade, or rent the property out soon, you’re often better off holding your current loan until the math actually works in your favor.

Because at the end of the day, refinancing isn’t about chasing the lowest rate…

It’s about knowing exactly when that rate pays off.

When Refinancing Is Not Worth It

Sometimes the smartest move is the one you don’t make.

Because while refinancing can save you money in the right situation, it can just as easily cost you more if the timing’s wrong.

Here are the red flags that usually mean refinancing isn’t worth it right now:

1. Rates Haven’t Dropped Enough

If mortgage rates have only dipped by a few tenths of a percent, the math probably doesn’t work out.

You’ll pay thousands in closing costs to maybe save a Starbucks run per week.

Most experts say you need at least a 0.75%–1% rate drop to make it worthwhile, depending on your loan size. Anything less, and you’re probably just spinning your wheels.

2. You’re Already Several Years Into Your Loan

If you’ve been paying on your mortgage for a while, you’re deep into the principal-heavy phase of your amortization schedule.

Refinancing into a new 30-year term resets that clock and you’ll go right back to paying mostly interest again.

Unless you’re refinancing into a shorter term, that move can actually cost you more in the long run, even if the monthly payment looks smaller.

3. You Plan to Sell or Relocate Soon

If you don’t expect to stay in your home for at least a couple more years, you probably won’t hit your break-even point.

Remember, refinancing costs money upfront. If you’re planning to move before you recoup those costs through monthly savings, the math doesn’t make sense.

(If you’re in this boat, check your numbers using Forbes Advisor’s refinance calculator, it’ll show exactly how long it takes to break even.)

4. You Have Prepayment Penalties or a Very Low Loan Balance

Some older or specialized loans include prepayment penalties—fees charged if you pay the loan off early (which is exactly what refinancing does).

Always check your current loan terms before you commit.

And if your balance is already low, say under $100,000, the savings from a small rate drop often won’t justify the closing costs.

So… Should You Refinance Your Mortgage Right Now?

If you’ve made it this far, you already know the answer isn’t as simple as “rates dropped, so refinance.”

Refinancing is part math, part timing, and part common sense. The smartest homeowners treat it like a business decision — because that’s exactly what it is.

If you’re looking at today’s numbers and checking off several of these signs—lower rates, stronger credit, more equity, or a long-term plan to stay put—then yes, it might finally be worth it.

But if the math doesn’t add up or you’re not sure you’ll stay in the home long enough to break even, it’s okay to wait. Rates move in cycles. Your finances evolve. The right opportunity always comes back around.

Remember:

- Refinancing to save money makes sense.

- Refinancing to feel like you’re doing something usually doesn’t.

If you’re still unsure where you stand, grab your latest mortgage statement and run your own numbers. A good rule of thumb? If the savings don’t outweigh the costs within two to three years, hold tight.

So before you lock a new rate, step back and ask the only question that really matters:

“Will this refinance actually move me closer to financial freedom… or just start the clock all over again?”

If you can answer that with confidence, then you already know what to do next.

Key Takeaway

At the end of the day, refinancing isn’t about chasing the lowest rate.

It’s about building the smartest long-term plan for your money.

Sometimes that means jumping on a refinance that saves you thousands, helps you ditch PMI, or shortens your payoff timeline.

Other times, it means looking at the numbers and realizing your current loan’s already doing its job just fine.

If you’re asking “should I refinance my mortgage,” the answer comes down to this:

- Will it move you closer to financial freedom?

- Or will it just restart the clock?

Run the math, weigh the timing, and make the move only when it truly benefits you — not because everyone else is doing it.

Because smart homeowners don’t just refinance. They refinance with purpose.