The Secret Your Bank Won’t Tell You

You’ve been paying that mortgage like a champ.

Maybe even throwing extra cash at the principal just to feel that little hit of financial pride.

Then one day, you stumble across something that makes you stop mid-scroll.

There’s a way to lower your monthly mortgage payment… without refinancing.

Wait… what?

Most homeowners have no idea this even exists.

It’s called a mortgage recast. And it’s one of those quiet money moves the banks don’t exactly advertise, because there’s not much in it for them…but a lot in it for you.

Here’s the short version. A mortgage recast lets you make a large lump-sum payment toward your principal, then asks your lender to recalculate your monthly payment based on the new, smaller balance. You keep the same interest rate, the same loan term—just a smaller payment.

No credit pull.

No new loan.

And usually, it costs less than what you’d spend on a decent weekend getaway somewhere in the $150 to $500 range.

It’s one of those little financial hacks that quietly works in the background, especially if you already have a low fixed rate and don’t want to touch it.

Big lenders like Fannie Mae and Freddie Mac even allow mortgage recasts under certain conditions, though not every bank will tell you about them upfront.

Here’s how it works and why it might save you thousands.

If you want to zoom out and see how this fits into your bigger picture, my guide on home equity walks through the ways banks structure things so homeowners save less than they should.

What Is a Mortgage Recast (and How Does It Work)?

A mortgage recast is one of those simple concepts that sounds complicated until you realize what’s actually happening.

In plain English… it’s when you pay a chunk of money toward your mortgage principal, then ask your lender to recalculate your monthly payment based on the new, smaller balance.

That’s it.

Your interest rate doesn’t change.

Your loan term doesn’t reset.

You’re not signing a new stack of paperwork or pulling your credit again.

All you’re doing is telling your lender, “Hey, I just knocked down a big piece of this loan—can you adjust my monthly payment to match?”

Let’s say your remaining loan balance is $400,000.

You come into some extra cash, maybe you sold a rental, got a big bonus, or inherited some money—and you decide to pay $50,000 toward the principal.

After your payment, your balance drops to $350,000.

Your lender then recalculates your monthly payment based on that new amount, while keeping your original interest rate and time left on the loan.

Same 3.25 percent rate.

Same 22 years left.

But now your monthly payment might drop a few hundred dollars.

That’s the power of a mortgage recast. It doesn’t make your loan shorter or lower your interest rate—but it makes your monthly cash flow a whole lot friendlier.

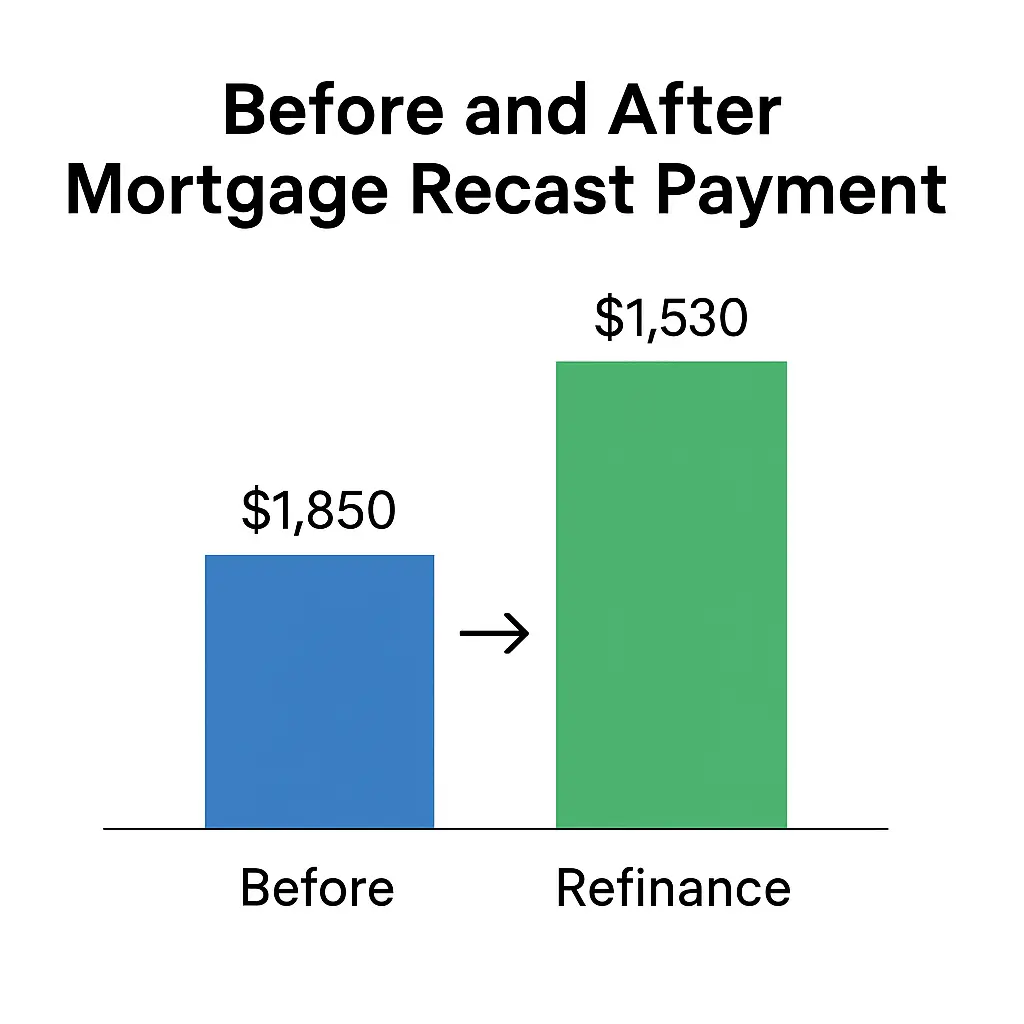

If you want a quick visual, picture it like this:

Before Recast

Loan Balance: $400,000

Monthly Payment: $1,850

After Recast

Loan Balance: $350,000

Monthly Payment: $1,530

The numbers are different, but the interest rate and term stay locked. It’s a quiet way to lower your cost of living without the paperwork circus of a full refinance.

For a more detailed breakdown of how loan amortization works when you make large principal payments, you can check out this overview from Investopedia.

Recast vs. Refinance: What’s the Difference?

A lot of people mix up mortgage recasting and refinancing because they both promise the same thing, lower payments. But they’re not the same animal.

Think of a refinance as trading in your mortgage for a brand new one.

A mortgage recast, on the other hand, is just re-tuning the one you already have.

When you refinance, your lender gives you a completely new loan with a new rate, new term, and a fresh set of closing costs to go with it. It can be worth it if you’re chasing a significantly lower interest rate or switching from an adjustable-rate loan to a fixed one. But the process is basically starting over from scratch.

A mortgage recast is the shortcut.

No credit check. No title company. No stack of disclosures to sign.

Just a simple recalculation of your payment based on your new balance.

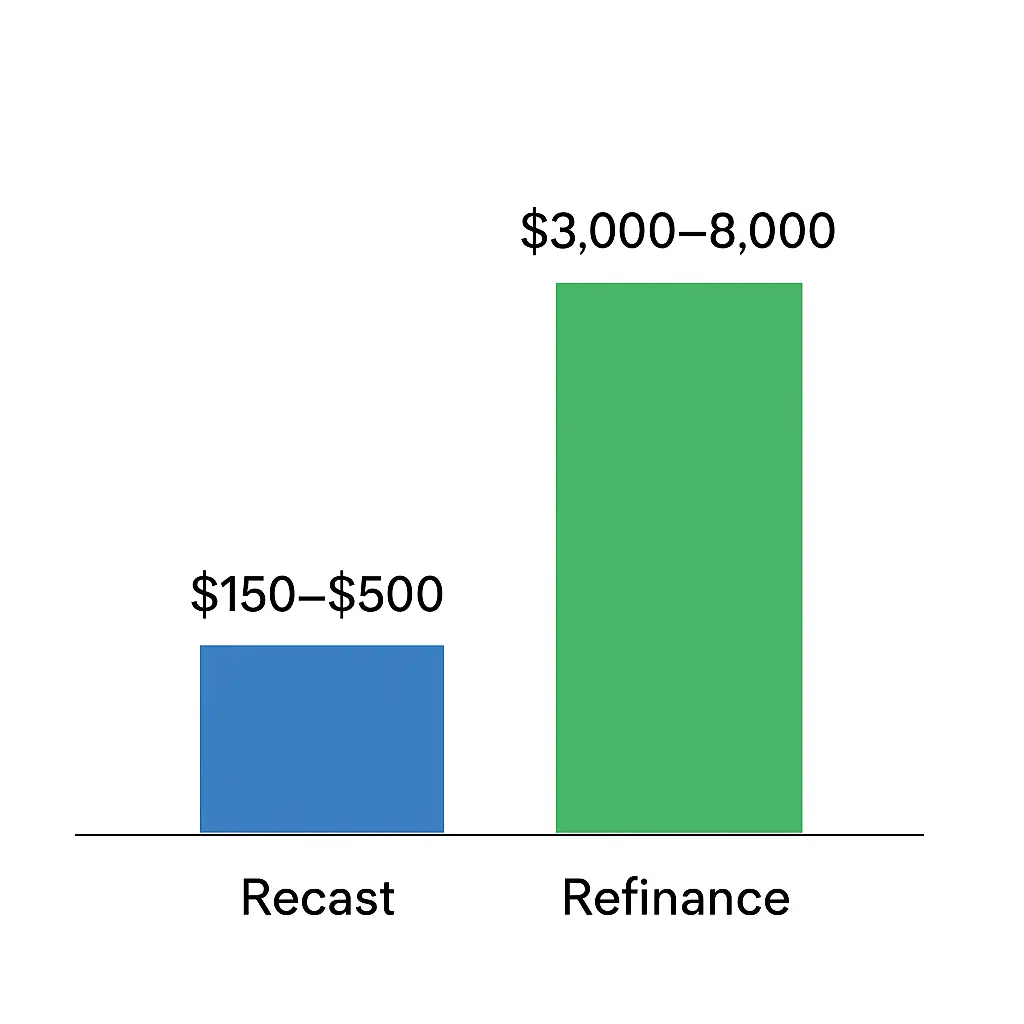

Here’s how they really compare:

| Feature | Recast | Refinance |

| Credit Check | No | Yes |

| New Loan | No | Yes |

| Fees | $150–$500 | $3,000–$8,000+ |

| Interest Rate Changes | No | Yes |

| Paperwork | Minimal | Full re-underwrite |

| Main Benefit | Lower payment | Lower rate or term |

If you already locked in a low rate a few years ago and just want smaller payments, a recast is usually the smarter play.

But if your interest rate is high and you plan to stay in the home for a while, refinancing might make more sense long-term.

For a more detailed look at refinancing and when it pays off, this Bankrate guide on refinancing basics breaks it down clearly.

When a Mortgage Recast Makes Sense

A mortgage recast isn’t something you do every day. It usually makes sense when you’ve come into a chunk of money and want to make it work harder for you.

Here are a few real-world situations where a recast is worth looking at:

You just sold another property and want to drop $50,000 on your current mortgage instead of letting the cash sit in a savings account doing nothing.

You received a big work bonus, an inheritance, or maybe even a severance package—and you’d rather use it to lower your monthly payment than spend it on a refinance you don’t need.

You’re sitting on a 2.9 percent rate from 2021. You’d be crazy to refinance and lose it, but you wouldn’t mind shaving $300 off your monthly payment.

Or maybe you just hate the idea of restarting a new 30-year clock. You’ve already made progress on your current loan, so recasting keeps the term the same while lightening the monthly load.

Mortgage recasting works best when your existing interest rate is already solid and you don’t need a full refinance to get a better deal.

💡 Pro Tip: You’ll get the biggest benefit early in your mortgage, when most of your payment still goes toward interest. The sooner you recast, the more impact that new lower balance will have over time.

If you want to dig deeper into how timing affects your payoff, Fannie Mae’s guide on mortgage amortization explains how each payment breaks down between principal and interest.

How to Recast Your Mortgage (Step-by-Step)

Recasting your mortgage isn’t complicated—it just takes a few phone calls and the right timing. Most lenders won’t automatically tell you it’s an option, so you’ll need to take the lead.

Here’s the step-by-step process:

1. Call your lender

Ask if they offer mortgage recasting. Many large banks and conventional loan servicers do, but not all. Smaller lenders or government-backed loans (FHA, VA, USDA) typically don’t allow it.

2. Make a lump-sum payment

You’ll need to pay a chunk toward your principal—usually at least $5,000, though some lenders require more. The bigger the payment, the bigger the impact on your new monthly amount.

3. Request a formal recast

Once your payment clears, ask your lender to officially “recast” your loan. They’ll run the numbers again and issue a new amortization schedule showing your updated balance and payment.

4. Pay the recast fee

Most lenders charge a one-time fee in the range of $150 to $500. It’s nothing compared to what you’d spend refinancing.

5. Get your new lower payment

Within 30 to 60 days, your new payment amount takes effect—and that’s it. No closing table, no appraiser, no credit inquiry.

Mortgage recasting is generally available only for conventional loans, and that’s what makes it appealing for homeowners who already locked in a low fixed rate.

If you’re unsure whether your loan qualifies, it’s worth checking your lender’s website or their investor’s rules. For example, Freddie Mac’s servicing guide outlines when a loan can be recast and what requirements need to be met.

When NOT to Recast

Like most money moves, a mortgage recast isn’t perfect for everyone. There are a few situations where it just doesn’t make sense—and being honest about that is important.

You probably shouldn’t recast if you’re planning to move in the next year or two. The upfront lump sum and small fee won’t have enough time to pay you back before you sell.

It’s also not worth doing if you can refinance into a much lower rate. For example, if you’re sitting at 6.5 percent and can drop to 5 percent with a new loan, the refinance will likely save you more over time—even with the closing costs.

If your mortgage is already close to being paid off, recasting won’t move the needle much either. Most of the payment savings from a recast happen early in the loan when there’s still a lot of interest left to be paid.

And finally, if your lender doesn’t offer recasting, you’re out of luck. Many smaller servicers simply don’t support it, so it’s worth asking before you send in any large lump-sum payment.

For homeowners comparing these choices side by side, Experian gives a clear explanation of when refinancing might be the better route.

Recast vs. Extra Principal Payments

Making extra payments toward your mortgage is always a smart move—but it’s not the same thing as a recast.

When you send extra money to your principal each month, it shortens your loan term and saves you interest over time. The catch is that your monthly payment doesn’t automatically drop. You’ll just pay the loan off faster.

A mortgage recast, on the other hand, officially resets your monthly obligation. You’re asking your lender to take your new, lower balance and stretch the remaining payments evenly across the rest of your loan term. That’s why your monthly payment goes down.

Here’s a quick example.

Let’s say your mortgage balance is $400,000 at 3.5 percent interest. You get a $50,000 bonus from work and decide to apply it toward your mortgage.

If you simply make that $50,000 payment, your balance drops to $350,000, but your monthly payment stays the same. You’ll just pay the loan off sooner.

If you choose to recast instead, your balance still drops to $350,000, but your lender recalculates your monthly payment based on that new amount. Same rate, same term but now your payment is smaller.

The best part is, you can combine both strategies.

Make extra payments whenever you want to chip away at the balance, and when the total starts to look significant, request a recast. That way you lock in the lower payment while still benefiting from the extra principal reduction.

For a simple breakdown of how both strategies impact long-term interest costs, this article from NerdWallet lays out the math clearly.

FAQs Homeowners Ask About Recasting

Here are some of the most common questions homeowners ask once they start looking into a mortgage recast.

No. Since you’re not applying for new credit or taking out a new loan, your credit score isn’t touched. It’s a behind-the-scenes adjustment on your existing mortgage.

Sometimes. Some lenders allow multiple recasts over the life of the loan, while others only permit one. It depends on the servicing rules for your specific loan.

Usually yes. Most lenders require at least $5,000 toward the principal before they’ll consider a recast. A few may set the threshold higher.

Typically not. Government-backed loans rarely allow recasting, which is why this option is most common with conventional mortgages.

Yes. That’s one of the best parts of a mortgage recast, you keep your current rate. Your payment just drops because the balance is smaller.

Real Example: How a $50K Recast Cut a Mortgage Payment by $320 per Month

Let’s run through a quick example to show how a mortgage recast actually plays out in the real world.

Say a homeowner owes $400,000 on their mortgage at a 3.25 percent interest rate. They sell a rental property and decide to put $50,000 of that cash toward their loan balance instead of letting it sit in the bank earning pennies.

They call their lender, pay a $250 recast fee, and within about a month, their new payment drops from roughly $1,850 to $1,530. Same rate. Same term. No refinance. No credit pull.

That’s a $320-a-month difference, all from one simple move.

Over a year, that’s nearly $4,000 in cash flow they get to keep—without changing a single thing about their mortgage structure.

It’s a quiet win, but it’s one of the smartest ways to lower your payment if you already have a good rate locked in.

For more on how lenders calculate payment adjustments after a lump-sum payment, this explainer from Rocket Mortgage walks through the process in detail.

The Overlooked Homeowner Hack

Recasting isn’t flashy. Nobody brags about it at dinner parties. It doesn’t have the excitement of buying a new house or the drama of refinancing paperwork piled up on your kitchen table.

But it’s quietly one of the smartest money moves a homeowner can make.

If you’ve got extra cash on hand and a low rate locked in, a mortgage recast lets you turn that money into monthly breathing room—without touching your rate or restarting your loan. It’s practical. It’s simple. And it’s something most people don’t even know exists until someone mentions it offhand.

The banks don’t talk about it much because there’s not a big profit margin in it for them. But for you, it can mean hundreds of dollars a month back in your pocket—without any of the usual refinance headaches.

If you want to see how much lower your payment could be, try my free Mortgage Recast Calculator below. It’ll show you exactly how a lump-sum payment changes your monthly cost and how fast you could hit your next financial goal.

For a deeper dive into how lenders structure recasts, this guide from Forbes breaks down eligibility requirements and real-world examples from major banks.