Introduction

Everyone keeps saying the same thing right now. No inventory. No good deals. Everything gets multiple offers the moment it hits the MLS. And honestly, a lot of that is true. But here’s the part most people miss. While everyone else is complaining, a small group of investors keeps picking up off market deals driving for dollars right under everyone’s nose.

A lot of that comes from driving for dollars. And it’s not what beginners think. You’re not out here hunting for houses that look like they survived a tornado. The real deals come from small signals most investors don’t even notice. Stuff that never shows up on a data list and can’t be pulled from software.

Most people rely on online listings or wait for a lead source to magically hand them a motivated seller. Meanwhile, the investors who get deals are the ones actually paying attention. BiggerPockets even talks about this, but most people still never dig deep enough to understand why it works.

My goal here is simple. Show you why driving for dollars works, what tiny details matter, and how to turn a basic drive through a neighborhood into a real stream of opportunities that other investors completely overlook.

If you want the full breakdown of every off market method investors use, not just driving for dollars, here is the complete guide.

What Driving For Dollars Actually Is (And Why It Still Works)

Driving for dollars is basically checking out neighborhoods in person and spotting homes that show early signs of distress. Not the dramatic stuff… just small clues that the owner might be overwhelmed or the property isn’t being maintained.

It works in any market because these signs show up long before anything becomes public. A sagging gutter or a tarp on the roof can appear months before a notice of default ever gets posted. ATTOM even shows how slow those filings can be, which means the early signals are only visible when you’re actually out there.

This is why the idea that all the deals are gone isn’t true. They’re not online yet. Most investors only look at MLS or Zillow, and by the time a distressed home hits those sites, the competition is insane.

Driving for dollars lets you find opportunities before anyone else notices them. And those early looks are usually where the best deals come from.

The Hidden Reason Driving For Dollars Outperforms List Stacking

List stacking is fine, but the problem is every investor buys the same exact data. If a property shows up on a pre foreclosure list, a tax list, or any public notice, thousands of people can see it instantly. That’s why those leads feel picked over.

Driving for dollars is different because you’re finding visual distress that no software can pick up. You can’t buy a list that shows weeds creeping up the siding, a half torn roof tarp, or a house that looks quietly neglected. Those clues only exist in person.

Most investors lean on tools because it feels easier. The downside is they’re always chasing the same leads as everyone else. When you’re actually driving, you end up finding owners who haven’t signaled anything on paper yet. No filings. No public records. Nothing that would ever hit a list.

That puts you in first position before anyone else even knows the property exists.

What Distress Really Looks Like (The Subtle Signals Most Investors Miss)

Most of the best driving for dollars leads aren’t the ones that look abandoned. They’re the ones with quiet, easy to miss problems that never show up on any online list.

Think of stuff like windows that are always closed, even on nice days. Gutters starting to sag. A side yard that looks like it hasn’t been touched in months. A tarp sitting on the roof that’s clearly been there longer than it should. An old car that hasn’t moved in forever. Peeling trim. Landscaping that’s starting to get out of control.

Individually, none of these scream distress. But together, they’re usually signs that the owner is checked out, overwhelmed, or falling behind on maintenance.

New investors drive right past these houses because they’re looking for something dramatic. Meanwhile, the real deals are the subtle ones sitting in plain sight.

How To Plan a Driving Route That Actually Produces Leads

Planning your route matters more than most people think. If you just hop in the car and start driving random streets, you’ll waste hours and come home with nothing. The goal is to target the right neighborhoods before you even leave the driveway.

Start by looking for older areas where maintenance is harder to keep up with. Neighborhoods built in the 60s, 70s, or 80s usually show distress earlier than newer subdivisions. You can also look for pockets with a lot of absentee owners, since those homes tend to slip faster. Transitional areas are another great target because they’re usually a mix of renovated homes sitting next to ones that clearly need work.

Google Maps makes this a lot easier. You can zoom in, look at roof conditions, check the age of the area, and even spot driveways or yards that look rough before you ever step foot in the neighborhood. I’ll also look for signs of investor activity like dumpsters, new roofs, or flipped houses nearby. That usually means other investors have already figured out the area has potential.

As far as timing, the best windows are late mornings or early evenings when lighting makes it easier to see the exterior clearly. Middle of the day works too, but avoid driving when it’s dark unless you’re trying to confirm if a house looks vacant.

A planned route saves you time, gives you way more leads, and puts you in neighborhoods where real distress actually exists.

How To Capture Leads Without Making Beginner Mistakes

A lot of beginners lose deals before they ever get started because their notes are sloppy. They’ll write down half an address, forget which street they were on, or mix up two properties that look similar. When they go back to skip trace the owner, nothing matches and they end up wasting time.

There are really two ways to track your driving for dollars leads. You can do it manually with a notes app or spreadsheet, or you can use an app that pins each address automatically. Manual works fine when you’re starting out, but you have to stay organized. App based tracking is easier, but you don’t need fancy software to get results.

No matter which method you use, always record the full address, what you saw, and any details that stood out. Peeling paint, an old tarp, overgrown grass, or a junked car all matter. If the house gives you even a small reason to check on it later, write it down.

You also want to avoid duplicates. This happens a lot when you drive the same neighborhood more than once. A simple way to avoid this is keeping a running list or using a map that shows everywhere you’ve already driven.

As far as how many leads you need, most people underestimate the volume. You’re usually not getting a deal from your first ten or twenty addresses. Realistically, you’ll need a couple hundred leads in your pipeline before you start seeing consistent traction. Some leads will never respond. Some won’t be motivated yet. The key is building a steady list and following up.

How To Skip Trace And Contact Owners

Once you’ve got a solid list of addresses, the next step is finding the owner. If you’re new, you can use free tools like county property records, Whitepages, or even basic Google searches to get started. They aren’t perfect, but they work well enough when you’re learning.

When you want more accurate results, paid tools like Propwire or Propstream usually give you cleaner phone numbers and emails. You don’t need them on day one, but they definitely save time once you’re working through larger lists.

Your outreach doesn’t need to be anything fancy. A simple message works best:

Hey, my name’s Josh. I was driving through the neighborhood and noticed your place. I wanted to see if you’d ever consider selling it. If not, no worries at all.

That tone feels normal and gets way more replies than aggressive investor language.

If you leave a voicemail, keep it short and avoid sounding scripted. Something like:

Hey, this is Josh. I was trying to reach you about a property you own. Whenever you get a minute, just give me a quick call back.

Follow ups matter more than most people realize. Try a simple rotation every few weeks. A call one time. A text the next. Maybe a voicemail after that. Nothing pushy. Just enough to stay on their radar so when they’re finally ready to sell, you’re the first person they think of.

Why Most Investors Fail At Driving For Dollars

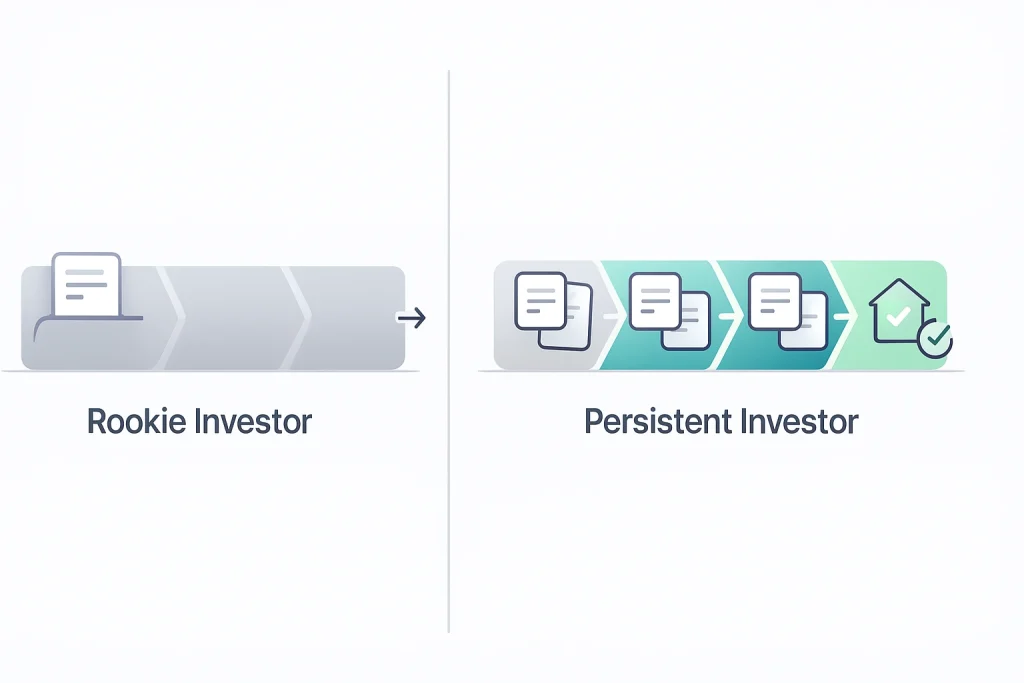

Most investors fail at driving for dollars because they treat it like a one time thing. They’ll go on two drives, get a handful of addresses, and then quit when nobody replies. They don’t realize this is a volume and consistency game.

A lot of them also never follow up. They send one text, get no response, and assume the lead is dead. The reality is most owners respond on the second, third, or even fourth attempt. If you’re only sending one message, you’re basically throwing the lead away.

Another common issue is not tracking anything. They don’t keep a list. They don’t organize their notes. They forget who they’ve contacted and when. Without a pipeline, everything becomes random and nothing ever compounds.

New investors also ignore the subtle distress. They’re looking for homes that look completely destroyed, but the best opportunities are the quiet ones that look a little off but not abandoned.

And the biggest mistake is trying to outsource everything too early. You can’t hand off driving for dollars or skip tracing until you understand what distress looks like and what a legitimate opportunity feels like. If you skip that learning curve, you end up paying for work that isn’t bringing in any deals.

Driving for dollars works. Most people just never stick with it long enough to get results.

Realistic Expectations: How Long Until Your First Deal

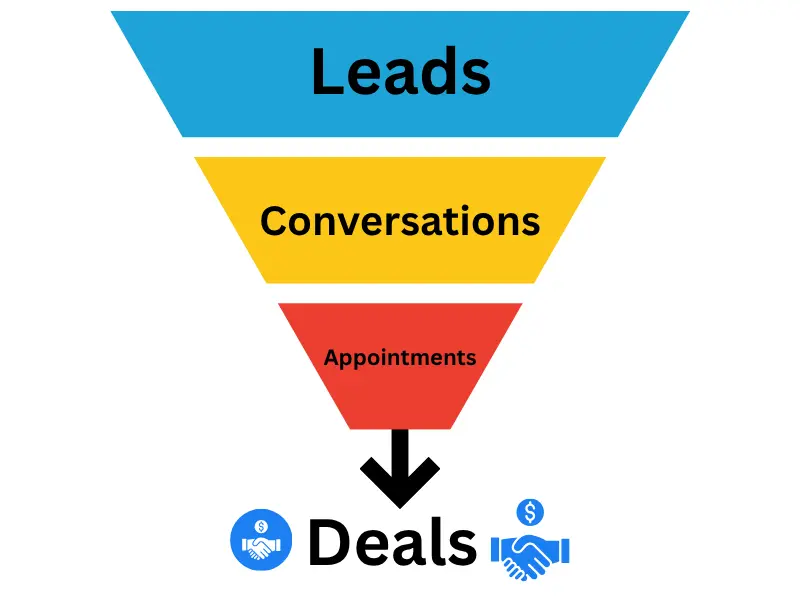

A lot of beginners think driving for dollars is going to land them a deal in the first week. It doesn’t work like that. You need enough volume in your pipeline before things start moving.

A good ballpark is around two to three hundred solid addresses before you see real traction. From those, maybe twenty to thirty owners will actually respond. Out of those conversations, you might get five to ten people who are open to talking further. And from those, one or two will turn into an actual appointment.

On average, only a small percentage of appointments turn into a deal. Sometimes it’s one out of five. Sometimes it’s one out of ten. It depends on motivation, timing, and whether the seller feels comfortable with you.

As far as weekly time, expect to spend a few hours driving and a few hours doing outreach and follow ups. It’s not full time by any means, but it does require consistent touches every week to keep your pipeline alive.

If you stay consistent, most people see their first deal in a couple of months. The ones who quit early usually stop right before the momentum kicks in.

Driving For Dollars vs Other Lead Gen Methods

Driving for dollars shines when other lead gen methods start feeling saturated. It easily beats cold calling when you’re tired of dialing the same list that every other investor in your market bought. With driving, you’re sourcing your own leads instead of hammering the same homeowners everyone else has already annoyed.

Driving for dollars also beats buying lists when you want exclusivity. Any time a list hits the market, hundreds of investors grab it instantly. Pre foreclosure lists, tax lists, code violation lists… they all get flooded with competition the moment they’re pulled. Driving gives you leads that aren’t on any list yet.

Compared to direct mail, driving is cheaper and more targeted. Direct mail still works, but you’re paying for postage, printing, and a big enough list to get any momentum. Driving lets you focus on the exact houses that already show signs of distress instead of mailing an entire zip code and hoping for the best.

The biggest advantage is that driving for dollars is the only method where you consistently find sellers nobody else has contacted. If you catch a house before it hits public data, you’re basically the first person in the world to know that opportunity exists. And being first almost always gives you the best shot at getting the deal.

The Tech Stack (Optional Tools That Make This Easier)

You don’t need a full software stack to make driving for dollars work, but the right tools can make life a lot easier once you start building a bigger list.

For paid driving apps, DealMachine is the one most investors end up using. It lets you pin properties while you drive, track your entire route, save notes, run skip tracing inside the app, and even send mail if you want to. It basically keeps everything organized so you don’t end up with random screenshots and half written addresses.

A simple CRM helps once you’re managing more than a handful of leads. A spreadsheet works when you’re new, but a CRM keeps your follow ups clean and prevents you from losing track of people who might reach out later.

Skip tracing software is another optional upgrade. Free searches are fine in the beginning, but paid tools usually give you cleaner data and way fewer dead numbers.

You can absolutely start with a free setup. Notes app, Google Maps, county property lookups, and a spreadsheet will get the job done. Paid tools make sense if you want speed, better accuracy, and a more streamlined workflow.

If you’re on a tight budget, start free. If you already know you’re committed to this and want everything organized from day one, tools like DealMachine are worth it.

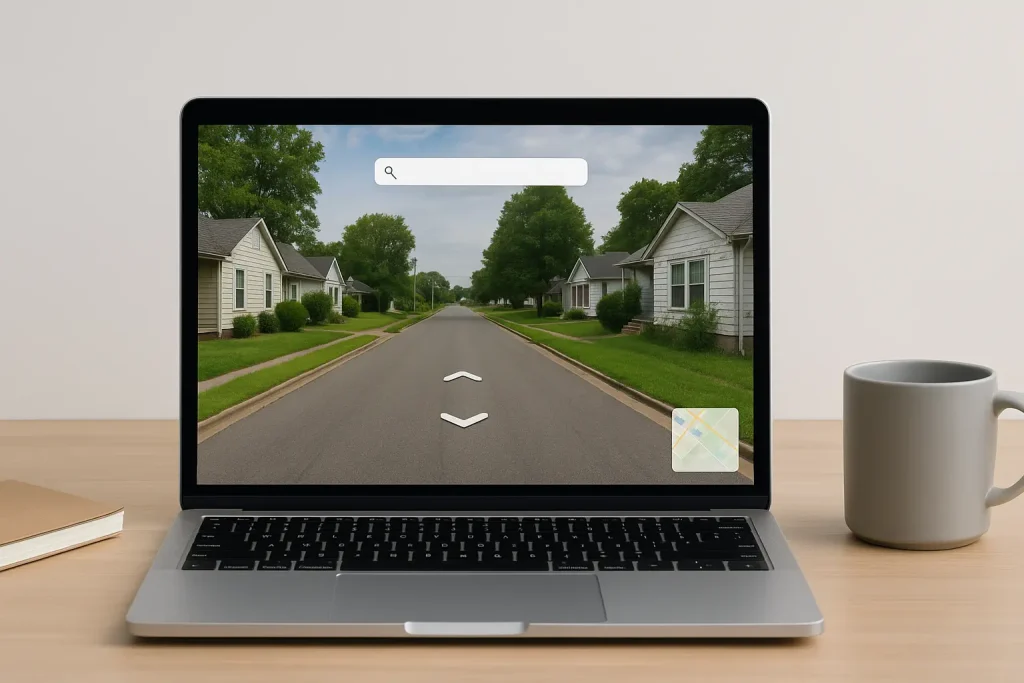

Advanced Technique: Virtual Driving For Dollars

Virtual driving for dollars is basically using Google Street View to scout neighborhoods without leaving your house. You can click through the streets, look at roof conditions, check the yard, and spot basic signs of distress before you ever get in the car. It’s a good way to pre filter areas so you’re not wasting gas driving through places with zero potential.

The results are usually lower compared to physically driving because Street View images can be outdated or miss small details. You won’t catch the fresh tarp on the roof or the yard that just started getting overgrown. But it’s still useful for narrowing down your targets and deciding where to spend your actual driving time.

A lot of investors combine virtual and physical driving for maximum efficiency. They’ll scout a few neighborhoods online, mark the streets that look promising, and then physically drive only the areas that showed potential on Street View. It saves time, cuts down on random wandering, and helps you build a more focused list.

It’s not a replacement for real driving, but when you stack both together, you end up covering more ground with way less wasted effort.

The Core Lesson

Driving for dollars works because it lets you spot opportunities long before they hit any data list. By the time a property shows up in public records, every investor in your market already knows about it. When you’re out there finding subtle distress early, you’re getting to the owner before anyone else even realizes the house might become a deal.

But the real magic is in the follow up. Most of your deals will come from staying consistent, reaching back out, and keeping your pipeline alive. One text or one call won’t cut it. The investors who win are the ones who stay on people’s radar without being pushy.

At the end of the day, most investors miss these opportunities because they rely on easy data instead of paying attention to small signals. If you’re willing to slow down, look closely, and stay consistent, you’ll find deals everyone else drives right past.