Why Home Equity Ends Up Costing People Money

Homeowners often overlook how their home equity can quietly work against them. The problem usually appears when Homeowners often overlook how their equity can quietly work against them. Many problems appear when people borrow without understanding their options. I have seen this happen to homeowners who thought they were making safe decisions. They walked into higher payments and long term costs they never expected.

Confusion grows when borrowing tools look similar. Some people open a HELOC without learning how a heloc works. Others refinance because a lender made it sound simple. A quick look at a home equity loan vs refinance comparison would have saved many people money. These situations grow expensive when someone does not know what each option truly does.

Small Home Equity Mistakes That Become Expensive

Several small choices usually create the biggest problems. Borrowing too early increases interest costs. Borrowing too late limits financial flexibility. Ignoring basic heloc qualifications leads to unexpected lender requirements. Overlooking a mortgage recast keeps payments higher than necessary. These choices may look harmless at first but hurt over time.

Why Lenders Do Not Explain Everything

Lenders often share information in a way that benefits them. Their explanations leave out key details that matter later. Many homeowners feel confident at first, then confused once payments adjust. If you want a neutral source, the Federal Deposit Insurance Corporation provides a clear guide.

The First Step Before Making Any Decision

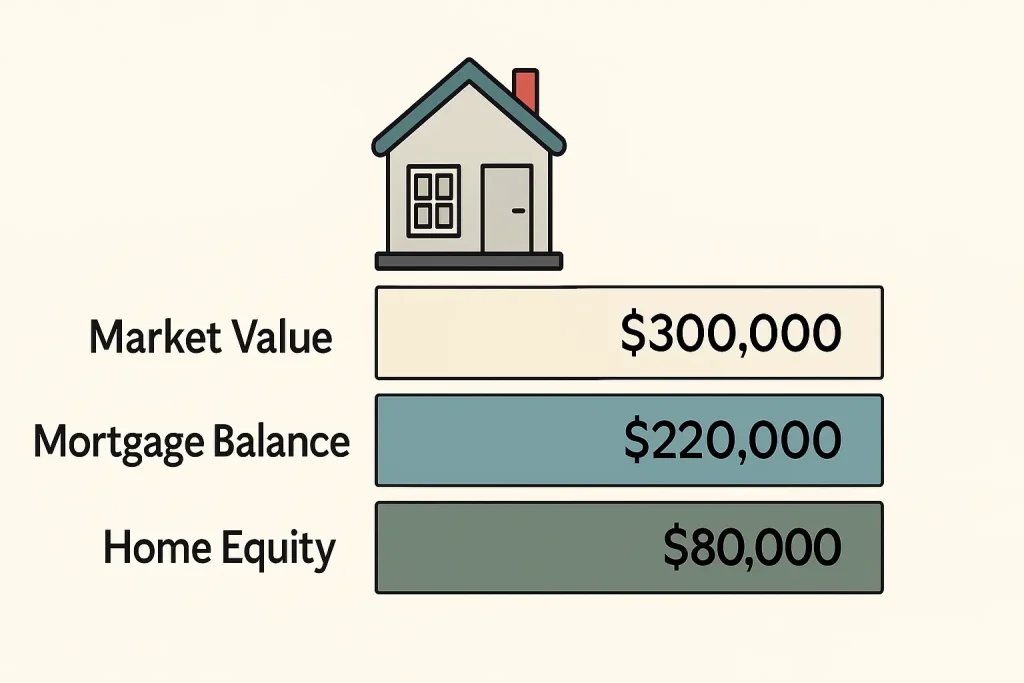

Understanding your equity amount helps you avoid blind borrowing. Many homeowners skip this step and end up guessing. Checking your numbers with my home equity calculator gives you a clean baseline. Once you know your numbers, every decision becomes far easier.

The Hidden Problem (Why Home Equity Can Cost You Money)

Many homeowners assume rising equity automatically helps their finances. Growing values look great on paper, but the benefit depends on how you use it. Equity becomes a problem when someone relies on assumptions instead of clear information.

Plenty of people sit on equity while carrying high interest debt. Their credit cards gain interest each month while cheaper options remain untouched. This mismatch slowly drains money and often goes unnoticed.

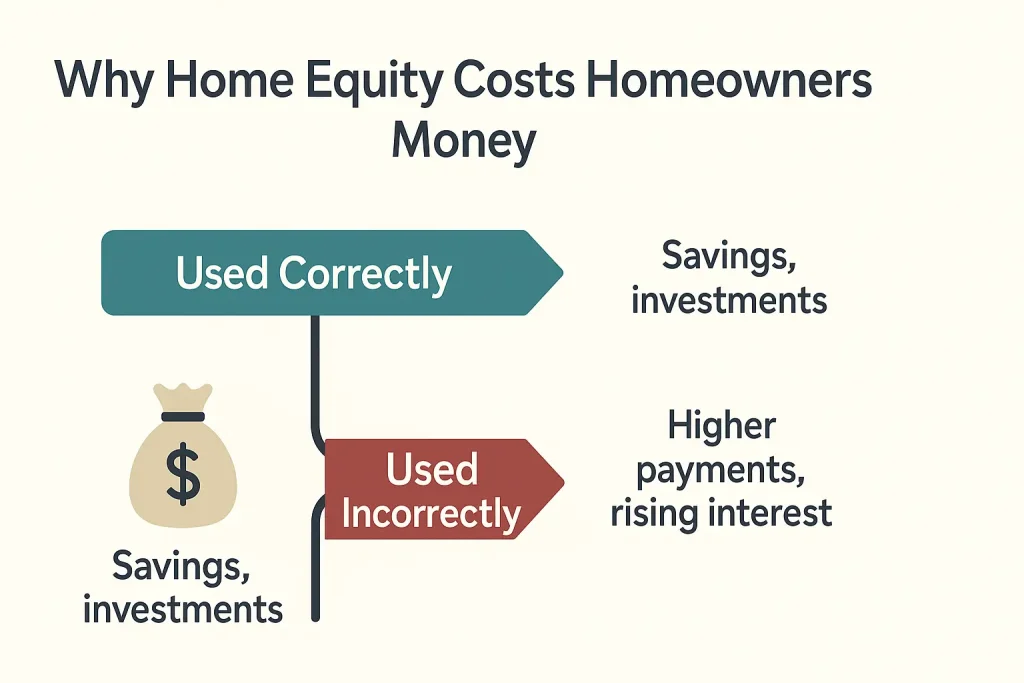

The Cost Comes From Incorrect Use

Different borrowing tools serve different purposes. A HELOC works better for short term needs. A home equity loan fits predictable payments. A refinance helps only when rates and goals align. Using the wrong option increases costs and adds long term pressure.

Borrowing too early increases total interest. Borrowing too late reduces flexibility. Small choices like these compound over time and create bigger problems.

Banks Promote Home Equity Products That Help Them Most

Lenders often highlight the benefits of products that favor their bottom line. Their explanations are usually accurate but incomplete. Missing details leave homeowners thinking they chose correctly, even when the numbers say otherwise.

Many people feel confident at first because the information sounds simple. Only later do they realize they did not understand the full picture.

Why Home Equity Matters Before You Borrow

Understanding these issues now helps you avoid expensive mistakes later. Better decisions come from knowing how each option works and when it makes sense. Once you grasp the basics, every step that follows becomes far clearer and much less stressful.

Why Homeowners Make the Wrong Home Equity Move

Many homeowners struggle to understand the differences between equity products. Each option sounds similar at first glance. A HELOC feels flexible. A home equity loan looks predictable. A refinance seems simple. A reverse mortgage appears helpful for older homeowners. These tools feel interchangeable, but they are not.

Misunderstanding these options leads to mistakes. One person may choose a HELOC for a long term project. Another may refinance when rates offer no benefit. Someone else might take a home equity loan when they needed flexibility. These decisions become expensive when the product does not match the goal.

Lenders Rarely Explain the Real Rules

Banks often present information in a way that highlights benefits and ignores tradeoffs. Their explanations sound clear but leave out important details. Homeowners think they understand the agreement, but many do not grasp how repayment changes over time.

Payment shifts feel small at first. Later, those changes create financial pressure. People feel caught off guard because the lender never explained the full picture.

Every Product Has One Ideal Use

Each equity tool performs best in a specific scenario. A HELOC works well for short term borrowing. A home equity loan fits fixed repayment needs. A refinance helps when rates align with long term plans. A reverse mortgage fits very specific retirement situations.

Using any of these tools outside their ideal lane raises costs. The wrong choice increases interest, reduces flexibility, and limits future options. Once you understand that, the decisions become easier.

If you want a deeper explanation of how a HELOC functions, you can read my guide here.

The Five Most Common Costly Home Equity Mistakes

Mistake 1: Borrowing With the Wrong Tool

Many homeowners pick the wrong borrowing option because the names sound similar. A HELOC feels flexible. A home equity loan offers predictable payments. Each tool works best in different situations. Short term borrowing usually fits a HELOC. Long term projects often need fixed payments. You can compare both options in my heloc guide.

Mistake 2: Refinancing When It Does Not Help

Plenty of people refinance without checking the math. Some lenders make refinancing sound simple, but the numbers tell the truth. A quick comparison between a home equity loan and a refinance would have prevented many expensive choices. You can see that breakdown here: loan guide. If you want a deeper look, I also explained when refinancing makes sense in this refinance guide.

Mistake 3: Ignoring HELOC Terms Until Payments Jump

HELOC payments change over time. Many people overlook this and feel shocked when the bill increases. Understanding the draw period and repayment rules prevents surprises. I broke this down in my heloc breakdown. You can also check the approval rules in my qualification guide.

Mistake 4: Missing Chances To Reduce Payments

Some homeowners never restructure their loan after rates drop. A simple change can reduce monthly payments without restarting the loan. Many people overlook this option because lenders rarely mention it. You can learn how it works in my recast guide.

Mistake 5: Turning Equity Into A Future Burden

Tapping equity the wrong way can limit future choices. Some older homeowners also choose reverse mortgages without understanding long term impacts. These loans fit a narrow group of people with specific needs. You can see the details in my reverse guide.

The Right Way To Use Home Equity

Most homeowners make better decisions when they match each goal to the right product. Every equity option has a specific purpose, and using the wrong one often leads to higher interest, limited flexibility, and regrets. Understanding these roles helps you avoid expensive mistakes and choose a path that actually supports your long term plans.

If You Want The Lowest Monthly Payment

A mortgage recast often provides the best result for lowering payments without restarting your loan. This move works well when you receive a bonus or lump sum but do not want a full refinance. Lenders rarely highlight this choice because it reduces your payment without generating extra fees for them. Many homeowners overlook it, even though it is simple and extremely effective.

If You Want Predictable Payments

A home equity loan fits people who want fixed payments that never change. The interest rate remains the same for the entire term, which helps with long term budgeting. This structure works best for large projects or debt consolidation when you want stable repayment and clear expectations.

If You Want Flexibility Or Future Borrowing

A HELOC becomes helpful when you need access to funds over time. The revolving line lets you borrow exactly what you need. This approach fits phased renovations, emergency buffers, or unpredictable expenses. Flexibility is the main advantage, but understanding payment changes is important before choosing this option.

If You Want To Remove PMI Or Improve Your Rate

A refinance helps when your interest rate decreases or your loan-to-value improves. Many people refinance too quickly or too slowly, but the numbers dictate the right timing. Reviewing your break even point prevents regrets and keeps the decision grounded.

If You Need Income Later In Life

A reverse mortgage fits older homeowners who need income without selling their home. This tool works best when someone has substantial equity and limited monthly cash flow. It is not perfect for everyone, but it can support specific retirement plans when used correctly.

Get Your Numbers Before Choosing Anything

Every borrowing decision becomes easier once you know your true equity amount. Many homeowners skip this and end up guessing. You can estimate your numbers with my HELOC calculator before selecting any option. A clear starting point prevents costly mistakes and keeps you in control.

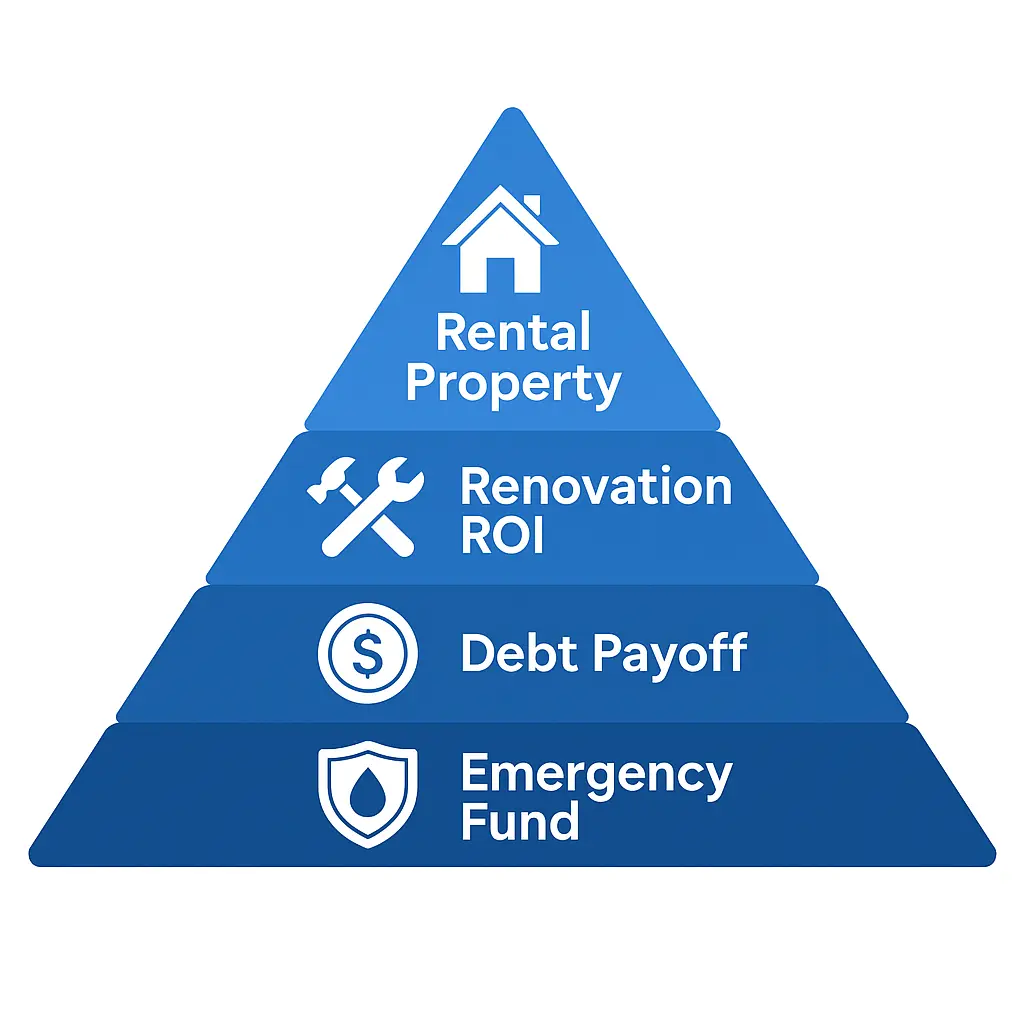

How To Use Home Equity To Build Wealth Safely

Homeowners often overlook how powerful their equity can be when used with a plan. Proper strategy helps you avoid unnecessary interest and long term risks. Many people focus on borrowing tools without considering whether the move supports future goals.

Rental Property Down Payments

Using equity for a rental property down payment can work well. The key is knowing the numbers before buying anything. Cash flow should stay positive after all expenses. Solid rental markets and reliable tenants matter more than buying something fast.

Renovation Returns

Renovations create value when you choose the right projects. Kitchens, bathrooms, and major mechanical upgrades often produce stronger returns. Smaller cosmetic updates help too, but structural repairs should always come first. A home equity loan works well for clear budgets.

Paying Off High Interest Debt

Using equity to remove high interest debt makes sense when the math supports it. Credit cards drain money quietly. Lower interest rates help reduce monthly pressure. Clear discipline prevents the debt from returning later.

Stock Market Lump Sum Strategies

Some homeowners invest a portion of their equity into long term index funds. Lump sum investing works best when tied to a strict plan. Avoid emotional decisions and keep the focus on long term growth. Only invest money you can leave alone for years.

Building An Emergency Buffer

Equity can also provide a safety buffer. Some people use a small portion to create a cash reserve. This helps cover emergencies without relying on credit cards. Savings first, investing second, borrowing last.

Learn The Full Wealth Strategy

If you want a deeper breakdown of these approaches, you can read my full guide here.

This guide walks through the numbers, risks, and scenarios in more detail so you can move forward with confidence.

Tools That Keep You From Choosing The Wrong Equity Strategy

Homeowners make better choices when they start with clear numbers. Many people skip this step and rely on guesses. A few simple tools solve most of this confusion by showing your equity, borrowing power, and monthly payment impact. These tools help you avoid costly decisions before they happen.

Free HELOC Calculator

The HELOC calculator estimates how much equity you can borrow. This tool works well for new borrowers who want flexible access to funds. Refinancers use it to compare options before changing their loan. Retirees check it to understand borrowing limits. People focused on reducing payments also benefit from knowing available equity. You can find it here:

heloc tool.

Free Home Equity Calculator

The home equity calculator shows your total available equity based on your current value and mortgage balance. New buyers use it to plan future borrowing. Refinancers check it to determine if a refinance makes sense. Retirees use it to evaluate long term planning. People trying to build wealth use it to compare investment ideas or debt payoff plans. You can use it here: equity tool.

Why These Tools Matter

Understanding your equity amount prevents blind borrowing. Many homeowners realize they could have saved thousands by checking their numbers first. These tools keep your decisions grounded in real information rather than assumptions.

Avoid The Expensive Home Equity Mistake

Most homeowners lose money because they use their equity the wrong way. The problem rarely comes from borrowing itself. The real issue comes from choosing the wrong product or ignoring better options. You are not losing money because you have equity. You lose money when your strategy does not match your goals.

Many people learn this after the damage is already done. Payments rise. Interest grows. Flexibility disappears. These problems feel small at first and grow over time. A simple plan helps you avoid every one of these issues.

Run Your Numbers First

A quick check with the free calculator gives you a clear starting point. Most homeowners skip this step and rely on random advice. Knowing your numbers helps you avoid blind decisions and expensive mistakes.

Learn More About Smart Homeownership

You can also subscribe to my newsletter for weekly homeownership tips. I break down strategies in a simple way. You get direct guidance without confusing lender language.

Compare Your Borrowing Options

Future guides will help you compare each option side by side. Clear comparisons make borrowing decisions easier. These tools remove the guesswork and help you stay focused on your long term goals.

Build A Plan That Matches Your Situation

Home equity becomes a powerful tool when used correctly. A simple framework keeps everything organized. Your financial goals guide the plan. Once you understand the right path, you avoid the costly mistakes many homeowners make each year.