Why This Guide Exists

Most people who Google real estate investing for dummies are not lazy or unintelligent. They are overwhelmed. They know there is money in real estate, but most explanations feel incomplete, exaggerated, or designed to sell them something too early.

If you have ever felt like everyone else got a secret playbook you missed, you are not behind. You are filtering out noise. And there is a lot of it.

One of the biggest sticking points for beginners is not motivation. It is execution. Understanding how deals are actually found and evaluated in the real world. That is why learning the real estate investing tools pros use matters more than flashy strategies that look good online but do not move you forward.

This article exists to reset expectations and strip away the hype before you go any deeper, so you can decide if this path actually makes sense for you.

Who This Is For

This is for normal people who want clarity, not hype. People with jobs, responsibilities, and limited patience for fluff. People who want to understand how real estate actually works before risking their savings or time.

If you want plain explanations and realistic expectations, you are in the right place.

Who This Is Not For

This is not for the quit your job in 90 days crowd.

It is not for anyone chasing screenshots of dashboards, rented supercars, or vague claims about passive income that somehow requires no capital, no experience, and no risk. It is not for people looking to outsmart math, markets, or time.

The Guru Nonsense This Guide Avoids

There are no Lambos here.

There are no fake passive income timelines where everything magically stabilizes after month three. And there are no zero down fairy tales that leave out the part where leverage cuts both ways.

Those stories exist to sell motivation, not outcomes.

What This Guide Promises Instead

What you will get instead is plain English. Real numbers. And realistic paths that normal people actually take.

Real estate investing is not complicated, but it is layered. Most beginner content either oversimplifies it to the point of being misleading or overcomplicates it to sound impressive. Both lead to confusion and inaction.

This guide strips things back to first principles. Where the money actually comes from. Where risk actually hides. And what decisions matter early on.

The goal is simple. Help you understand the game well enough to decide whether you even want to play. And if you do, help you move forward with eyes open instead of hope alone.

What Real Estate Investing Actually Is (No Buzzwords)

Real estate investing is not a shortcut to money. It is a long term decision to trade liquidity and convenience for gradual financial progress. You buy property, you manage risk, and you get paid slowly over time. Not magically. Not all at once.

That framing matters because most confusion starts with unrealistic expectations. If you think investing means instant income or effortless returns, every normal obstacle will feel like failure. In reality, those obstacles are the process.

When you invest in real estate, you are committing capital to an asset that has moving parts. Tenants come and go. Expenses are uneven. Markets shift. The job early on is not optimization. It is survival and stability.

Once that clicks, the rest becomes easier to evaluate honestly.

What Investing Means In Real Life

In real life, investing means owning something that can underperform in the short term while still working over the long term.

You buy property knowing the numbers will never be perfect. You manage risk by leaving margin for repairs, vacancies, and bad timing. And you accept that most of the payoff shows up years later, not months later.

This is why patience matters more than cleverness early on. The people who get hurt are not usually reckless. They are rushed. They expect the asset to behave like a side hustle instead of a balance sheet item.

Real estate rewards consistency and restraint far more than aggression.

The Three Ways Real Estate Investors Make Money

Real estate does not rely on a single source of return. It works because multiple forces compound together over time, even if none of them look impressive on their own.

Cash flow is the monthly spread between income and expenses. Rent comes in. Mortgage, taxes, insurance, maintenance, and vacancies go out. What is left over is cash flow. In many markets today, this number is thin or nonexistent at first, which is why relying on it alone is risky.

Appreciation is the long term increase in property value. This is driven by inflation, supply constraints, and local demand. It is slow and uneven, but over long periods it has done most of the heavy lifting for wealth creation in real estate.

Equity paydown is the least talked about and most misunderstood. Every payment reduces your loan balance. Tenants help pay it down. Time compounds it quietly. This is forced savings built into the structure of the investment.

Most guru content focuses on only one of these, usually cash flow.

That is because it is easier to market a monthly number than a ten year outcome. But real estate works best when all three are present, even modestly. Understanding that balance resets expectations and prevents you from judging good deals by the wrong criteria.

The Main Ways People Invest In Real Estate (Ranked For Beginners)

There are several ways to invest in real estate, but not all of them make sense when you are starting out. The biggest mistake beginners make is picking a strategy based on what looks exciting instead of what is forgiving.

This section is about orientation. You should finish it knowing which paths are beginner friendly, which ones are not, and why choosing the boring option early is usually the smartest move.

Long-Term Rentals (Boring, Effective, Scalable)

Long-term rentals are the default beginner path because they are the most forgiving when you make small mistakes. You buy a property, rent it to a tenant, and collect monthly rent over long periods of time.

What good enough looks like here is stability, not perfection. Slightly positive or break-even cash flow. A property that stays occupied most of the year. Expenses that are predictable enough to plan around.

The tradeoff is time versus stability. Rentals require patience and occasional hands-on involvement, especially early on. In exchange, you get durability. This strategy compounds quietly and gives you multiple ways to win over time, which is why so many experienced investors still favor it.

House Flipping (Not Beginner-Friendly, Despite YouTube)

Flips look easy online because the hard parts are edited out. The delays. The cost overruns. The stress of carrying a property with no income.

Beginners lose money here because flipping has thin margins and zero tolerance for mistakes. One bad contractor, one inspection surprise, or one market shift can wipe out profits entirely.

Flips do make sense once you have experience, capital, and reliable systems. They are execution-heavy projects, not beginner investments. Treating them like entry-level real estate is how people get burned fast.

Short-Term Rentals (Higher Upside, Higher Complexity)

Short-term rentals promise higher income, but they come with higher operational complexity. Airbnb is not passive. It is hospitality, pricing strategy, maintenance, and customer service rolled into one.

Regulatory risk is real. Cities change rules. Insurance costs fluctuate. Seasonality can turn strong months into weak years.

This strategy is best suited for people who enjoy operations and can tolerate income swings. It can work very well, but only if you treat it like a business, not a shortcut.

REITs (The I Want Exposure Without Headaches Option)

REITs allow you to invest in real estate without owning physical property. You buy shares of companies that own and operate real estate assets and receive dividends.

They are boring, and that is the point. No tenants. No repairs. No midnight phone calls.

REITs are useful if you want exposure to real estate returns without operational risk. They will not teach you how to manage property, but they can be a solid complement or starting point for cautious beginners.

The key takeaway is simple. The best beginner strategy is the one that lets you survive long enough to learn. Complexity can come later.

How Much Money You Really Need To Start (No Guru Math)

Most beginner anxiety around real estate comes from not knowing the true cost of entry. Not the purchase price, but the cash required to survive the early months without panic. Once you see the full picture, the fear usually drops.

For most beginners, the money needed falls into three buckets.

Down payments are the most obvious. Depending on the loan type and whether the property is owner occupied or an investment, this can range from a low single digit percentage to something closer to twenty percent. The exact number matters less than understanding that leverage increases both upside and downside.

Closing costs are where many people get blindsided. Lenders, title companies, attorneys, taxes, and insurance all want their cut upfront. A rough planning range of two to four percent of the purchase price keeps expectations realistic without being overly conservative.

Reserves are the part gurus love to ignore. This is your buffer. Cash set aside for vacancies, repairs, insurance increases, or a bad tenant. Many experienced investors sleep better knowing they have several months of expenses available per property. Beginners should treat this as non negotiable, not optional.

This is why no money down deals are usually a bad idea early on.

They are rare in normal markets. They are risky because there is no margin for error. Or they require experience, relationships, or deal flow you do not have yet. When something goes wrong, and something eventually will, there is nothing to absorb the hit.

The better question is not how little money you can put in.

It is how much risk you can afford to carry without it affecting your life. If one repair bill or vacancy would derail your finances, the deal is too tight. Real estate rewards people who plan for friction, not those who assume everything goes right.

The Only Beginner Strategy That Consistently Works

The beginner strategy that works most consistently is not creative, aggressive, or exciting. It is simple, repeatable, and intentionally boring. Simplicity beats cleverness because it reduces the number of variables that can go wrong at the same time.

Most early failures in real estate are not caused by bad markets. They come from doing too many new things at once. New location, new property type, new financing, new renovation scope, new management plan. When everything is unfamiliar, it is impossible to tell what actually caused the problem.

Simple strategies limit the damage when mistakes happen.

Why Simple Beats Clever

Clever strategies look good on paper because they assume perfect execution. Real life rarely cooperates. Every extra layer you add increases the chance of delay, cost overruns, or decision fatigue.

Simple strategies are easier to evaluate honestly. You know what rent should be. You know typical repair costs. You know what normal looks like. That baseline is what allows you to spot problems early instead of reacting late.

Early on, the goal is not to maximize returns. It is to stay in the game long enough to learn.

The Case For One Market

One market means learning how prices, rents, taxes, insurance, and demand actually behave in a specific area. Patterns start to emerge once you focus.

You begin to recognize overpriced listings, realistic rents, and neighborhoods that consistently perform better than others. That local intuition does not transfer instantly to new markets. It has to be earned.

The Case For One Property Type

Every property type has different risks. Single family homes, small multifamily, condos, and mixed use all behave differently.

Sticking to one property type keeps your learning curve manageable. Maintenance, tenant profiles, financing, and resale dynamics stay consistent enough to compare deals accurately.

The Case For One Repeatable Process

A repeatable process turns decisions into habits. How you analyze deals. How you budget repairs. How you screen tenants. How you plan reserves.

When your process is consistent, outcomes become easier to predict. That predictability is what builds confidence without arrogance.

Diversification comes later because it only works when you understand what you are diversifying away from. Early diversification spreads attention thin and slows learning. Depth first. Breadth later.

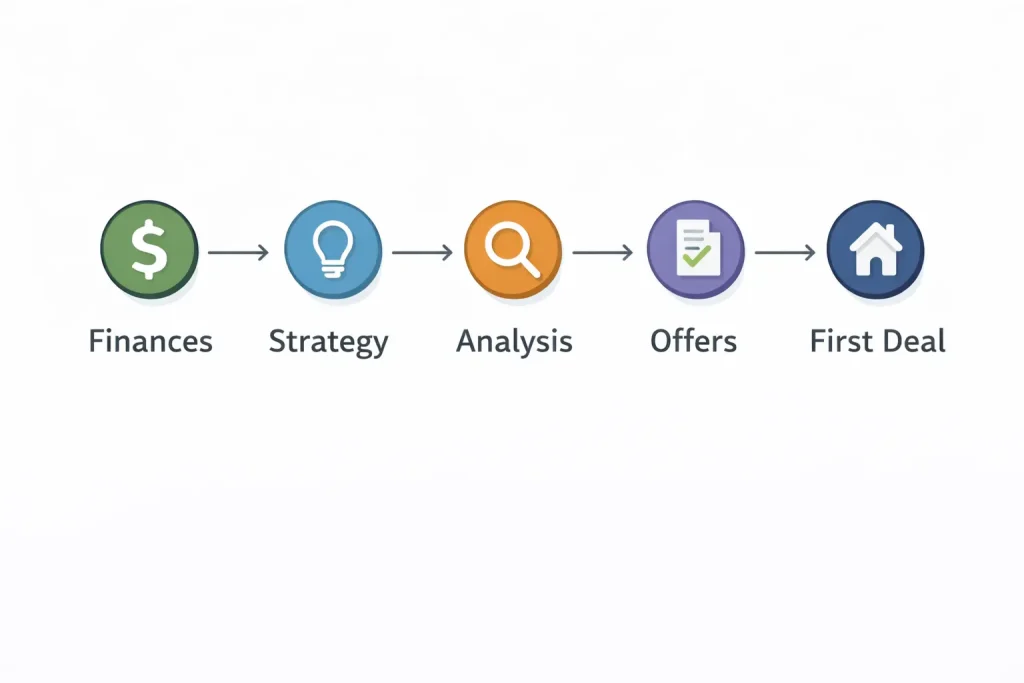

A Step-by-Step Beginner Roadmap (Zero To First Deal Thinking)

The fastest way to stall out as a beginner is trying to learn everything at once. The fastest way to move forward is following a simple sequence that builds confidence without forcing premature decisions. This roadmap is not about speed. It is about reducing avoidable mistakes.

Each step removes a specific type of uncertainty. Skipping steps does not save time. It usually just moves the confusion downstream.

Understand Your Finances And Credit

Start by understanding what you can actually support, not what a calculator says you qualify for. Income stability, existing debt, credit profile, and cash reserves all shape your real buying power.

This step is about constraints. Knowing them upfront prevents emotional decisions later when a deal looks exciting but stretches you too thin.

Pick One Investing Strategy

Choose one strategy and ignore the rest for now. Long term rentals, short term rentals, or something else, but only one.

This decision simplifies everything that follows. Financing, deal analysis, market selection, and risk tolerance all depend on the strategy you commit to first.

Learn How Deals Are Analyzed

Before you look at properties seriously, learn how numbers are evaluated. Income, expenses, financing terms, and reserves should all be part of the picture.

You do not need advanced models. You need consistency. The goal is being able to quickly tell if a deal is obviously bad, potentially workable, or worth deeper analysis.

Talk To Lenders Early

Lenders are not just gatekeepers. They are information sources.

Talking early helps you understand realistic loan terms, down payment requirements, and how different property types are treated. This prevents surprises after you already have your heart set on something.

Study Your Local Market

Market knowledge reduces fear. Study recent sales, typical rents, days on market, and price ranges that actually move.

You are not trying to predict the future. You are trying to understand what normal looks like so you can spot when something is off.

Make Offers That Make Sense

Most offers will not get accepted. That is normal.

Writing offers based on numbers instead of excitement builds discipline. Rejection is part of the filtering process, not a signal that you are doing something wrong.

Buy When The Numbers Work

The final step is the hardest because it requires restraint. You buy when the numbers work, not when the story feels good.

Excitement fades quickly. Math does not. The goal of this roadmap is not your first deal at any cost. It is your first deal that does not put you in a hole on day one.

Real Estate Terms You Actually Need (Explained Like A Human)

A lot of beginner intimidation comes from terminology, not complexity. The words sound technical, so people assume the concepts must be advanced. In reality, most real estate terms describe very basic ideas that get overcomplicated on purpose.

You do not need to memorize jargon. You need to understand what actually affects your money.

Cash Flow (What You Keep, Not What Gurus Brag About)

Cash flow is what is left after everything is paid. Not rent. Not gross income. What you actually keep.

That means rent minus mortgage, taxes, insurance, maintenance, vacancies, and management. If someone shows you a deal and only talks about rent minus mortgage, they are skipping the part that hurts.

Positive cash flow is nice. Break even is common early on. Negative cash flow can be acceptable only if you clearly understand why and how long you can sustain it.

ROI (What Matters Versus What Does Not)

ROI measures how efficiently your invested money is working. It sounds precise, but it is often misused.

High ROI projections usually assume perfect conditions. What matters more is whether the assumptions are conservative and repeatable. A lower return that actually happens beats a higher return that only exists in a spreadsheet.

ROI is a comparison tool, not a promise.

Cap Rate (When It Matters And When It Does Not)

Cap rate is a way to value income producing property without financing. It is useful for comparing similar properties in the same market.

It matters more in commercial and multifamily contexts. It matters less for single family homes, especially when financing, appreciation, and personal risk tolerance play larger roles.

If someone insists cap rate is the only number that matters for every deal, they are oversimplifying.

Equity (The Quiet Wealth Builder)

Equity is the portion of the property you actually own. It grows as the loan balance goes down and the property value goes up.

This is where patience pays off. Equity does not feel exciting month to month, but it compounds steadily over time. Many long term investors build most of their wealth here without realizing it at first.

Leverage (Useful, Dangerous If Abused)

Leverage means using borrowed money to control a larger asset. It amplifies outcomes in both directions.

Used conservatively, leverage accelerates growth. Used aggressively, it removes margin for error. The goal is not maximum leverage. It is survivable leverage.

Understanding these terms reduces intimidation because they stop feeling mysterious. Once the language is clear, the decisions become easier to evaluate calmly instead of emotionally.

The Risks No One On YouTube Wants To Talk About

Real estate looks safe online because risk is rarely shown. Missed rent, surprise repairs, and long stretches of nothing happening do not make good thumbnails. But these are the parts that determine whether an investment is survivable or stressful.

Understanding these risks does not make real estate less attractive. It makes it easier to plan for reality instead of reacting to it.

Vacancy Risk

Vacancy is not an edge case. It is a normal part of owning property.

Tenants move. Life changes. Markets soften. Even good properties experience downtime. Every month without rent turns fixed expenses into out of pocket costs.

The mistake beginners make is underwriting deals as if full occupancy is permanent. It never is. The goal is not to eliminate vacancy. It is to survive it without panic.

Repairs And Capital Expenses

Repairs are not evenly distributed over time. They cluster.

A water heater can last years and then fail in one afternoon. Roofs, HVAC systems, plumbing, and electrical do not care about your spreadsheet assumptions. These are capital expenses, not inconveniences.

Ignoring them does not make them go away. Planning for them turns emergencies into line items.

Interest Rate Risk

Financing is not static. Rates change. Loan terms reset. Refinancing assumptions break.

If a deal only works under perfect financing conditions, it is fragile. Rising rates can turn thin margins negative quickly, especially for investors who stretched too far initially.

Rate risk matters more when leverage is high and reserves are low.

Market Stagnation

Markets do not always go up. Sometimes they go sideways for years.

This matters because appreciation is often treated as a guarantee instead of a variable. When prices stagnate, the only things carrying the deal are cash flow and equity paydown.

Buying with the assumption that appreciation will bail you out is speculation, not investing.

Why Cash Flow Does Not Cover Everything

Cash flow helps, but it does not protect against every scenario.

It does not prevent major repairs. It does not eliminate vacancy. It does not shield you from regulatory changes or insurance spikes. Treating cash flow as a cure all leads to underestimating risk elsewhere.

Real estate works when multiple buffers exist at the same time. Margin, reserves, patience, and realistic expectations. Ignoring risk does not make deals safer. Acknowledging it does.

Is Real Estate Still Worth It In Today’s Market?

Every cycle creates the same question. Prices feel high. Rates feel restrictive. Competition feels unfair. And people assume the opportunity already passed them by. That feeling is not new. It shows up in every generation, usually right before the next phase of long term growth quietly begins.

Skepticism is healthy. Paralysis is not.

Why Every Generation Thinks They Missed It

People anchor to past prices. What homes cost ten or twenty years ago feels like the reference point, even though the economic backdrop has completely changed.

Inflation, population growth, supply constraints, and monetary policy reshape the baseline over time. When you compare today’s prices to yesterday’s environment, it always looks late. That comparison is emotionally satisfying but analytically useless.

Most long term investors did not buy at perfect moments. They bought when deals made sense relative to their own finances.

What Matters More Than Timing

Trying to time markets assumes precision that does not exist. What actually determines outcomes is execution over long periods.

Buying right means underwriting conservatively, leaving margin for error, and not stretching just to get in. Good purchases are resilient. Bad ones rely on luck.

Holding long enough allows time to do its job. Loan balances decline. Rents adjust. Inflation works quietly in the background. Short holding periods magnify noise. Long holding periods smooth it out.

Managing risk is what keeps you invested when conditions change. Adequate reserves, reasonable leverage, and realistic expectations matter far more than entry timing.

Why Real Estate Is A Long Game

Real estate is not a hack because it does not reward impatience. It rewards people who structure deals to survive volatility and then stay put.

The biggest wins rarely come from single transactions. They come from accumulation over time. Multiple properties. Multiple cycles. Small advantages compounding quietly.

If you are looking for certainty, real estate will disappoint you. If you are willing to play the long game, it has a track record of rewarding discipline more than brilliance.

Common Beginner Mistakes (That Cost Real Money)

Most beginner losses do not come from bad luck. They come from predictable patterns that repeat over and over. Seeing them clearly once can save you years of frustration and expensive lessons.

This section is meant to interrupt those patterns before they turn into habits.

Over-Renovating

New investors often renovate to their own taste instead of the market’s expectations. High end finishes feel productive, but they rarely produce proportional returns.

The goal is functional and durable, not impressive. Every dollar spent should have a reason tied to rentability or resale. Anything beyond that is usually ego disguised as improvement.

Chasing Trendy Strategies

Trendy strategies spread because they photograph well. Not because they work consistently.

Short term rentals, creative financing, and complex deal structures are often presented as shortcuts. In reality, they add layers of risk that beginners are not equipped to manage yet.

Mastering fundamentals first makes advanced strategies optional instead of necessary.

Ignoring Reserves

Running lean feels efficient until something breaks.

Ignoring reserves turns normal expenses into financial stress. Repairs, vacancies, insurance increases, and tax reassessments are not rare events. They are inevitable ones.

Reserves are not idle cash. They are what allow you to stay rational when things go wrong.

Trusting Spreadsheets Instead Of Reality

Spreadsheets assume clean inputs and predictable outcomes. Real life does not.

Rent gets delayed. Contractors miss deadlines. Repairs uncover more repairs. Numbers on paper should be tested against real world friction, not treated as guarantees.

Models are tools, not truth.

Learning From People Who Do Not Own Property

Advice is cheap online. Ownership is not.

Learning from people who have never held a property through a full cycle leads to shallow confidence and fragile strategies. Experience introduces humility. It forces respect for risk.

The fastest way to improve judgment is learning from people who have survived mistakes, not just explained theories.

What To Learn Next (Without Falling Into Guru Hell)

Once the basics click, the next risk is not ignorance. It is overload. Too much information, delivered without structure, creates confidence without clarity. This is where a lot of beginners drift into guru territory without realizing it.

The goal now is depth, not volume.

What To Focus On Next

Deal analysis should be your first priority. Not advanced modeling, but consistent evaluation. Understanding how income, expenses, financing, and reserves interact on real properties builds intuition faster than theory ever will.

Market fundamentals come next. Learn how supply, demand, local employment, and pricing trends affect your specific area. National headlines matter less than neighborhood level behavior. Context turns data into insight.

Personal risk tolerance is the part most people skip. How much volatility can you handle without losing sleep or making emotional decisions. Two investors can buy the same property and experience it completely differently based on this alone.

Why Weekly Structured Learning Works Better

Binge watching YouTube feels productive, but it fragments attention. Every video introduces a new strategy, a new metric, or a new fear.

Weekly structured learning compounds. One concept at a time. One decision framework at a time. Enough space to reflect and apply instead of consume.

Real understanding is built slowly. The investors who last are not the ones who know the most tactics. They are the ones who built a process they trust and then followed it consistently.

This Is Boring On Purpose

If this all feels less exciting than what you see online, that is the point. Boring strategies build wealth because they survive contact with reality. They do not rely on perfect timing, constant attention, or things going exactly right.

Real estate rewards people who make repeatable decisions under imperfect conditions. The same type of deal. The same underwriting assumptions. The same margin for error. Over time, those small, unremarkable choices compound into something meaningful.

Skepticism is not a flaw in this process. It is a filter. It keeps you from chasing ideas that only work in highlight reels and spreadsheets. It forces you to ask better questions and slow down when something sounds too clean.

You do not need hype to build wealth. You do not need motivation cycles or bold predictions about the next hot strategy. You need decisions you can live with when the market is quiet, when repairs show up, and when progress feels slow.

That is what real estate actually is. Not a hack. Not a shortcut. A long series of ordinary decisions made consistently enough to matter.

If that sounds boring, you are probably on the right track.