What a HELOC Actually Is?

Let’s start with a real talk refresher: a home equity line of credit, or HELOC, isn’t magic money. It’s your home talking.

You’ve built up equity — the difference between what your home is worth and what you still owe on it — and a HELOC lets you borrow against that value. You’re basically saying, “Hey lender, I’ve got skin in the game. Let me tap into some of it when I need to.”

According to the Consumer Financial Protection Bureau, a HELOC is an open end line of credit secured by your home, which means your property acts as collateral if you default. That’s why lenders take these applications so seriously. They’re not handing out unsecured credit cards; they’re literally tying their money to your biggest asset.

Here’s the key thing most homeowners miss: because your house is the collateral, lenders aren’t just checking a few boxes and calling it a day.

They’re digging deep — credit history, income stability, debt load, and how much equity you’ve got left all get scrutinized. They want to see that you can handle the responsibility of a revolving line of credit tied to your home.

Here’s why that matters:

- Unlike a personal loan or credit card where you’re only promising to repay, a HELOC puts your property on the line. If you fall behind, the lender can foreclose. That’s why most banks are far more conservative with approvals.

(See Investopedia’s guide on how HELOCs work and why they’re riskier than they look.)

- Since a HELOC works like a revolving account, you can borrow, repay, and borrow again during what’s called the draw period. It’s flexible, but that flexibility means lenders want proof you’ll manage it responsibly.

(For a breakdown of the structure and repayment timeline, check Bank of America’s overview of home equity lines of credit here.)

- Finally, lenders zero in on your loan to value ratio (LTV). If your house is worth $400,000 and you owe $320,000, that’s an 80% LTV, usually the upper limit for qualification. Anything higher and you’ll likely need to build more equity first.

(You can see Bankrate’s explanation of how LTV affects HELOC eligibility here.)

In short, a HELOC is one of the most powerful tools for homeowners, but it’s also one of the most misunderstood.

Lenders don’t just care about how much you can borrow; they care about how safely you can borrow.

If you want a clearer picture of why equity can help or hurt your finances, this guide breaks down the biggest mistakes homeowners make with their equity.

So before hitting “Apply,” make sure your finances look the part. A clean credit history, manageable debt, and solid equity position can make all the difference when it comes to getting approved — and getting the best rate.

The 5 Core Qualifications Lenders Look At

When it comes to HELOC qualifications, lenders don’t care how nice your house looks or how good your intentions are. They care about numbers.

These are the five big factors they check before saying yes — and knowing them upfront can save you a ton of frustration.

1. Your Credit Score

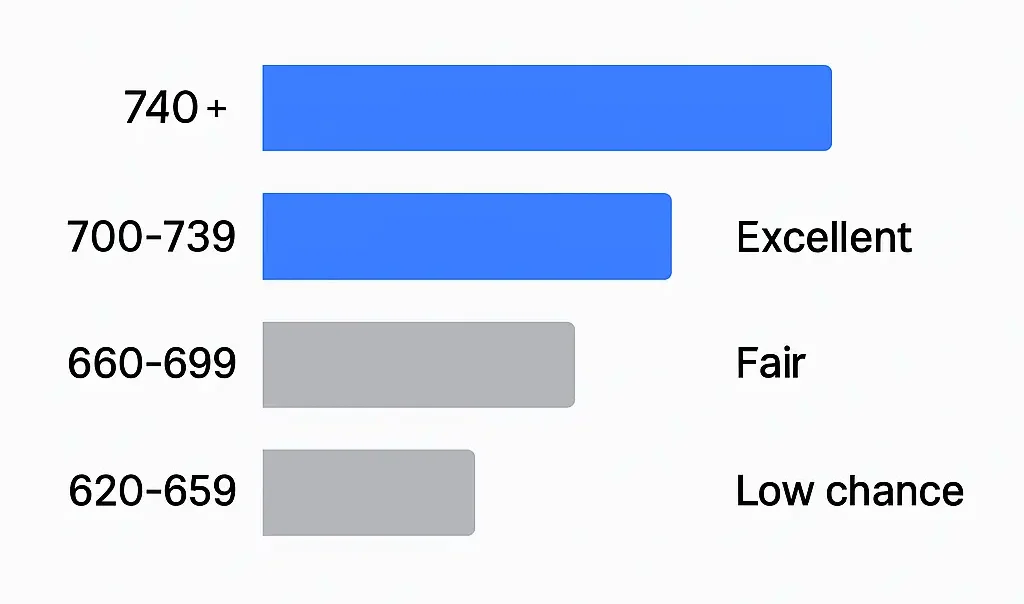

This is the first gatekeeper. Most lenders want to see a credit score of 680 or higher, but if you’re north of 700, you’ll usually get better rates and higher limits.

Why it matters: your credit score tells the lender how risky you are to lend money to. It’s not just about missed payments — it’s how much credit you’re using, how old your accounts are, and how consistent you’ve been paying everything on time.

If your score is below 680, don’t panic. You can improve it faster than you think by paying down balances, keeping old accounts open, and catching up on any late payments.

2. Your Home Equity and Loan to Value Ratio

Your home’s equity is the backbone of every HELOC approval. Lenders want to make sure you’ve still got skin in the game.

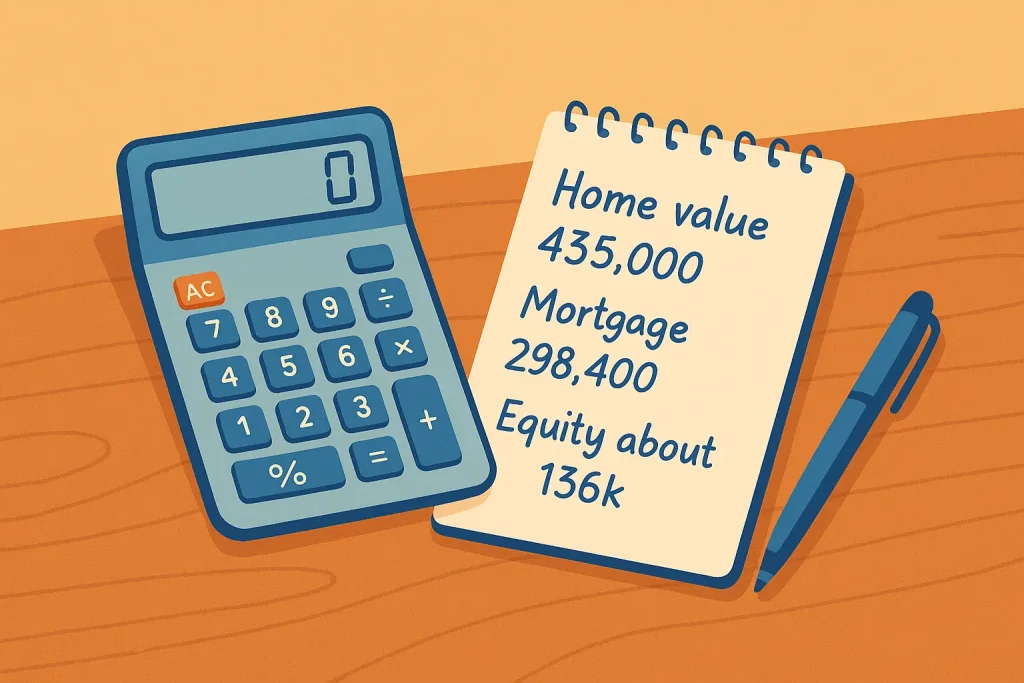

Here’s the basic formula:

Home Value – Mortgage Balance = Home Equity

Most lenders will only let you borrow up to 80 to 85 percent of your home’s current value. That percentage is called your loan to value ratio, or LTV.

Example:

If your home’s worth $400,000 and you owe $260,000, you’ve got $140,000 in equity. At 80 percent LTV, you could qualify for a HELOC around $60,000.

If you want a calculator to run your own numbers, the Federal Housing Finance Agency has a reliable tool for estimating home values and equity trends.

3. Your Debt to Income Ratio (DTI)

Lenders also care about how much of your income is already spoken for each month. This is your debt to income ratio, or DTI.

It’s a simple formula:

Monthly Debt Payments ÷ Monthly Gross Income = DTI%

Most banks want to see a DTI under 43 percent, but under 36 percent is ideal. The lower your DTI, the safer you look on paper — and the higher your chances of getting approved.

If you’re over the limit, paying down credit cards or small personal loans can make a big difference fast.

4. Your Income and Employment History

Lenders want to know your income is stable and verifiable.

If you’re a W-2 employee, that’s easy — your last two pay stubs and a recent W-2 usually do the trick. If you’re self-employed, it’s a little more work. Expect to show two years of tax returns and possibly profit and loss statements.

Even if your income fluctuates, consistency matters more than perfection. Lenders like to see a steady track record, not sudden drops or gaps.

5. Your Property Type and Occupancy

Not every property qualifies for a HELOC. Most lenders prefer primary residences, since those carry the lowest risk.

You can still get a HELOC on a second home or rental property, but expect tighter rules, lower borrowing limits, and sometimes higher rates.

Every lender is different here, but Fannie Mae’s guidelines give a good overview of how property type affects eligibility.

Bottom Line: Lenders are simply trying to measure risk. The stronger you look across these five factors — credit, equity, debt load, income stability, and property type — the smoother your approval process will be.

And if one of those areas needs work, fix that first. It’s usually cheaper and faster to qualify strong the first time than to settle for a higher interest rate later.

What Can Disqualify You (Even If You Think You Qualify)

Here’s the truth — even if you look great on paper, a few hidden factors can still derail your HELOC application. These are the most common dealbreakers lenders flag, and most are easy to fix if you catch them early.

1. Too Much Debt

A strong credit score won’t save you if your debt to income ratio (DTI) is too high. Most lenders want to see DTI under 43 percent, ideally closer to 36 percent. If your monthly payments already eat up most of your income, that HELOC will be a tough sell.

2. Not Enough Equity

If you recently refinanced, you might have less equity than you think. Most lenders cap total borrowing (your mortgage plus HELOC) around 80 to 85 percent of your home’s value. Use the FHFA Home Price Index Calculator to estimate where you stand.

3. Low Appraisal Value

Zillow estimates don’t count. The lender’s appraisal is what matters. If it comes in low, your available equity shrinks — and so does your approval amount. A clean, well-maintained home can help the appraiser see full value.

4. Unstable Income

Even with solid equity, inconsistent or unverifiable income can stop an approval cold. Lenders want stability — steady pay stubs, tax returns, or two years of self-employment proof.

5. Liens or Missed Payments

Old tax liens, second mortgages, or recent missed payments make lenders nervous. They want to be second in line after your main mortgage, not third or fourth. Clean these up before applying.

Getting denied for a HELOC doesn’t always mean you’re in bad shape — it just means the math isn’t working right now. Pay down debt, build more equity, or give your credit a few months to recover. A quick cleanup today can turn that “no” into a “yes” later.

How to Instantly Improve Your Odds of HELOC Approval

Getting approved for a HELOC isn’t just about luck — it’s about positioning yourself as low risk. The good news? You can make small moves today that dramatically improve how lenders see you.

Here’s what actually works.

1. Pay Down Debt Before You Apply

Your debt to income ratio (DTI) is one of the biggest factors in HELOC qualifications. Every extra dollar you free up by paying off credit cards or small loans gives you more breathing room — and better approval odds.

Start with high-interest balances first. Even a $2,000 payoff can shift your DTI enough to make a difference.

2. Check Your Credit Report for Mistakes

Before you apply, pull your free report from AnnualCreditReport.com. You’d be surprised how many reports contain errors — outdated accounts, incorrect balances, or late payments that never happened.

Dispute anything inaccurate, pay down balances below 30% of your limits, and avoid opening new credit lines until after your HELOC is approved. These small tweaks can raise your score fast.

3. Increase Your Home’s Appraised Value

Lenders base your borrowing limit on home value, so small upgrades can go a long way. Focus on quick wins like landscaping, curb appeal, and finishing minor repairs.

If you’re unsure what adds value in your market, the National Association of Realtors offers a data-driven list of remodeling projects that improve appraisal value.

4. Prepare Income Documentation

Whether you’re a W-2 employee or self-employed, have your paperwork ready. Lenders love clean, organized documentation — it signals reliability.

For employees: two recent pay stubs and last year’s W-2.

For self-employed borrowers: two years of tax returns and a year-to-date profit and loss statement.

Being ready up front can speed up approval and avoid back-and-forth requests.

5. Avoid Multiple Loan Applications

Every time you apply, your credit takes a small hit. If you shop around, use prequalification tools that rely on soft pulls instead of full credit checks.

Too many hard inquiries in a short period can look desperate to lenders — even if you’re just comparing rates.

6. Build Equity Faster

If your equity is just shy of qualifying, start making extra principal payments on your mortgage. Even small additional payments can shave thousands off your balance and push you into approval range within months.

Improving your HELOC qualifications doesn’t mean overhauling your entire financial life. It’s about timing, cleanup, and strategy.

By tightening your debt, fixing your credit, and knowing your home’s real value before applying, you’re showing lenders exactly what they want to see — a homeowner who’s in control.

What If You Don’t Qualify Yet?

So, you ran the numbers, checked your credit, and the lender still said no.

Don’t take it personally — a HELOC denial doesn’t mean you’re doing something wrong. It usually just means the math isn’t working yet. The good news is, you can turn that around faster than you think.

1. Build More Home Equity

Your home’s equity is the backbone of any HELOC approval. If you’re under the 15–20% equity threshold, start chipping away at your mortgage balance.

Make extra principal payments when you can — even small amounts help.

If your property value has increased recently, consider asking your lender for a new appraisal after a few months. Rising prices alone can shift your eligibility.

2. Work on Your Credit Score

If your credit is below 680, focus on the basics — pay every bill on time, lower your credit card balances, and don’t open new accounts right before reapplying.

Credit scores move more quickly than most people realize. With consistent effort, you can often improve your score within a few months.

3. Reduce Your Debt Load

If your debt-to-income ratio is the problem, pay down what’s easiest to eliminate first — high-interest credit cards, car loans, or personal loans.

Even one paid-off account can free up enough room in your DTI to push you over the approval line.

4. Reapply Strategically

Don’t rush to apply again right away. Wait until something materially changes — your credit improves, your income stabilizes, or your equity grows. That’s when the numbers will work in your favor.

And if you’ve been denied before, ask the lender why. By law, they’re required to tell you the specific reason. Once you know what held you back, you can focus your efforts where it actually matters.

5. Explore Other Options

If you still don’t qualify, a HELOC might not be your best move right now — and that’s okay.

You can look into:

- A home equity loan for a fixed amount and rate.

- A cash-out refinance if rates drop or your first mortgage is older.

- A personal loan if you only need a small amount short term.

Think of it less as a “no” and more as a “not yet.”

Getting Approved for a HELOC Starts with Preparation

It isn’t about luck, it’s about showing lenders you’re in control of your finances.

They’re not just checking boxes. They’re weighing risk. That means strong credit, steady income, manageable debt, and enough equity to prove you can handle borrowing against your home.

If you’re not quite there yet, that’s okay. A few small tweaks — paying down high-interest debt, cleaning up credit errors, or letting your equity grow — can shift your application from borderline to approved faster than you think.

Take the time to strengthen your financial position now, and when you apply again, you’ll walk in with leverage. Better terms, better rates, and a smoother process — all because you prepared the right way.