The Confusing Truth About HELOCs

When you Google “how does a HELOC work,” you get a pile of robotic explanations that sound like they were written by the same people who invented fine print.

Prime rate this. Draw period that.

And somehow, after reading three “expert” guides, you still don’t actually understand how any of it works in real life.

My First Wake-Up Call

When I first started digging into home equity lines of credit, I thought it was just a fancy name for a second mortgage.

Then the banker started talking about draw periods, repayment periods, and combined loan-to-value ratios—and I realized:

This isn’t something they want you to understand clearly.

The less you know, the easier it is for them to slide in fees and terms you didn’t even know existed.

If you want a quick breakdown of how homeowners accidentally lose money with their equity, this overview explains it cleanly.

Let’s Strip Away the Jargon

Here’s the truth: a HELOC isn’t complicated once you ditch the banker language.

It’s basically a revolving credit line backed by your house.

You borrow against your home’s equity—use what you need, pay it down, borrow again.

Simple enough, right?

Well… until you factor in variable interest rates that move faster than your electric bill in July, and repayment periods that can quietly double your payment overnight.

What You’ll Learn in This Guide

In this post, we’re breaking it all down — in plain English, with real-world examples and zero financial fluff.

You’ll learn:

- How lenders actually decide your credit limit

- What “draw” and “repayment” periods really mean

- The sneaky traps to avoid before signing anything

If you want the official definition, the Consumer Financial Protection Bureau (CFPB) gives a decent breakdown.

But let’s be honest — they’ll tell you what it is.

I’m going to show you how it really works when it’s your house and your money on the line.

What Exactly Is a HELOC?

f you’ve ever wondered how does a HELOC work in plain English, here it is:

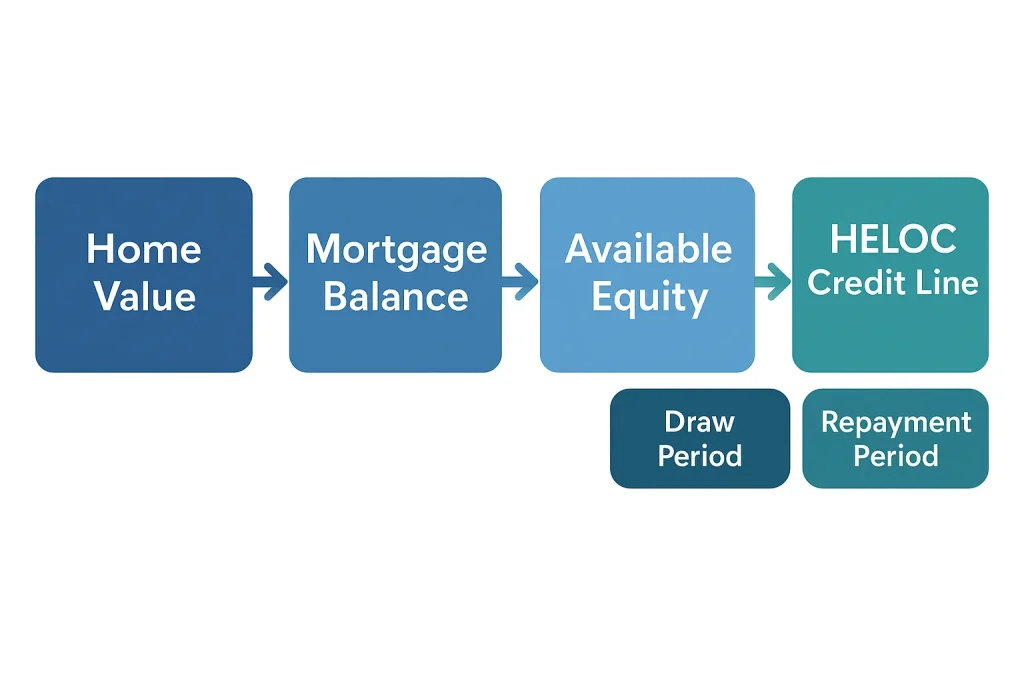

A HELOC (Home Equity Line of Credit) is basically a revolving line of credit secured by your home’s equity.

It works a lot like a credit card — but instead of being backed by your income or a plastic card in your wallet, it’s backed by the portion of your home you actually own.

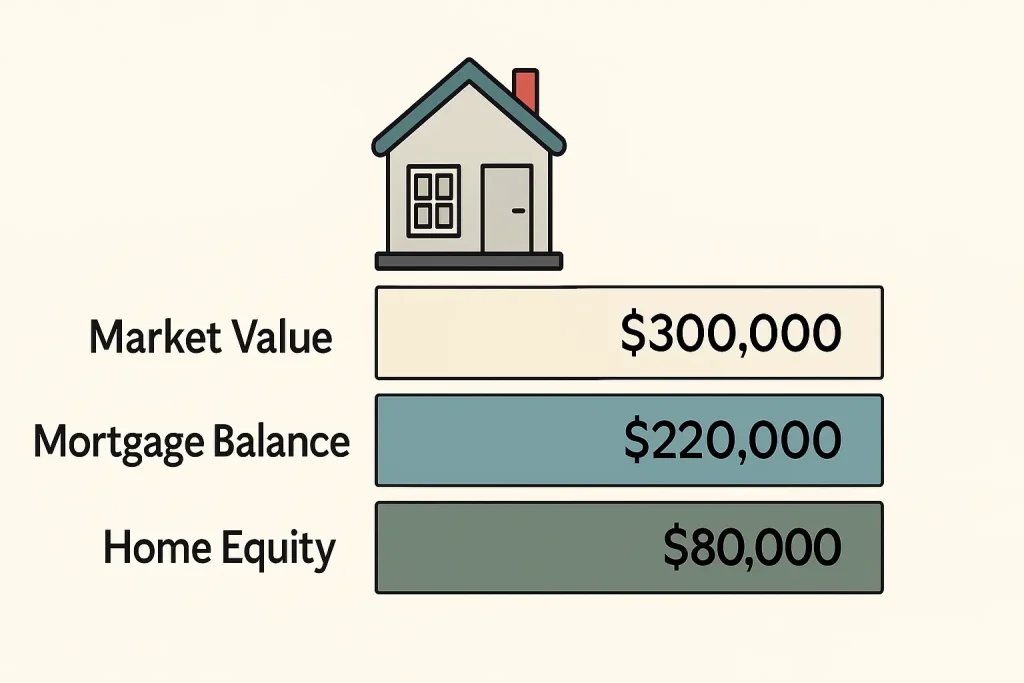

A Simple Way to Picture It

Let’s say your home is worth $400,000 and you still owe $260,000 on your mortgage.

That means you’ve built up about $140,000 in equity.

Now, your lender probably won’t let you borrow all of that — most will cap your access around 80–85% of your home’s value (minus what you owe).

So in this case, the bank might offer a $60,000 HELOC limit.

That’s your credit line. You don’t have to take all of it at once — you just borrow what you need, when you need it, and pay interest only on what you actually use.

💬 Example: If you use $10,000 from your HELOC to remodel your kitchen, you’ll only pay interest on that $10,000 — not the full $60,000 limit.

It’s Not a One-Time Loan… It’s a Flexible Tool

The biggest misconception is thinking a HELOC works like a traditional loan. It doesn’t.

A home equity loan gives you a lump sum upfront with fixed payments.

A HELOC, on the other hand, acts more like a checking account tied to your equity — funds in, funds out, as needed.

You can borrow, repay, and borrow again — over and over — during what’s called the draw period (we’ll break that down next).

Why It Exists in the First Place

Banks created HELOCs to give homeowners more flexibility — and let’s be honest, to make more money off your home long after you’ve bought it.

For some people, it’s a smart move. For others, it’s an easy way to dig a deeper financial hole.

It all depends on how you use it — and whether you truly understand how it works before signing those papers.

How Lenders Decide How Much You Can Borrow

Here’s where most people get lost when they ask how does a HELOC work.

Because the truth is — the bank isn’t lending you what you want; they’re lending you what their math allows.

Step 1: They Start With Your Home’s Value

The first number that matters is your home’s appraised value.

Not what Zillow says, not what your neighbor got — but what a certified appraiser decides your house is worth today.

This number sets the stage for everything else.

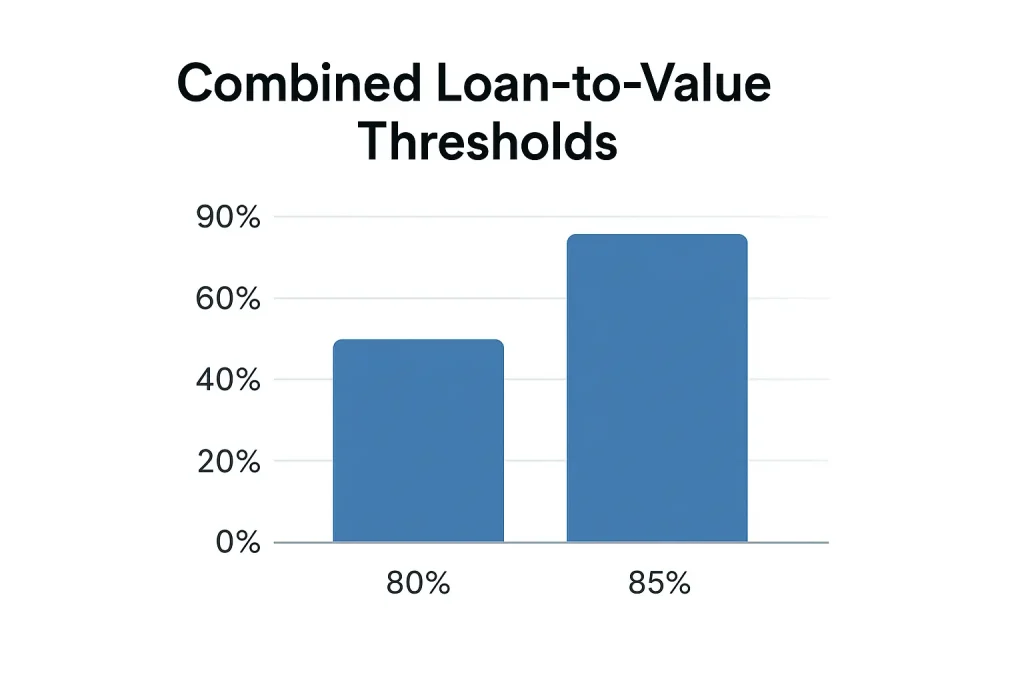

Step 2: They Use the “Combined Loan-to-Value” Formula (CLTV)

This is the part that sounds complicated but isn’t.

Here’s the simple version:

CLTV = (What You Owe + What You Borrow) ÷ Home Value

Most lenders allow you to borrow up to 80% to 85% of your home’s value combined between your mortgage and your HELOC.

Example: A Real-World Breakdown

Let’s say your home appraises at $400,000 and your current mortgage balance is $250,000.

If your lender allows 85% CLTV, here’s the math:

$400,000 x 0.85 = $340,000 (max total debt allowed)

$340,000 – $250,000 = $90,000 (max HELOC line)

So your potential HELOC limit would be around $90,000.

That doesn’t mean you have to use all of it — it just means that’s the most you could borrow if you wanted to.

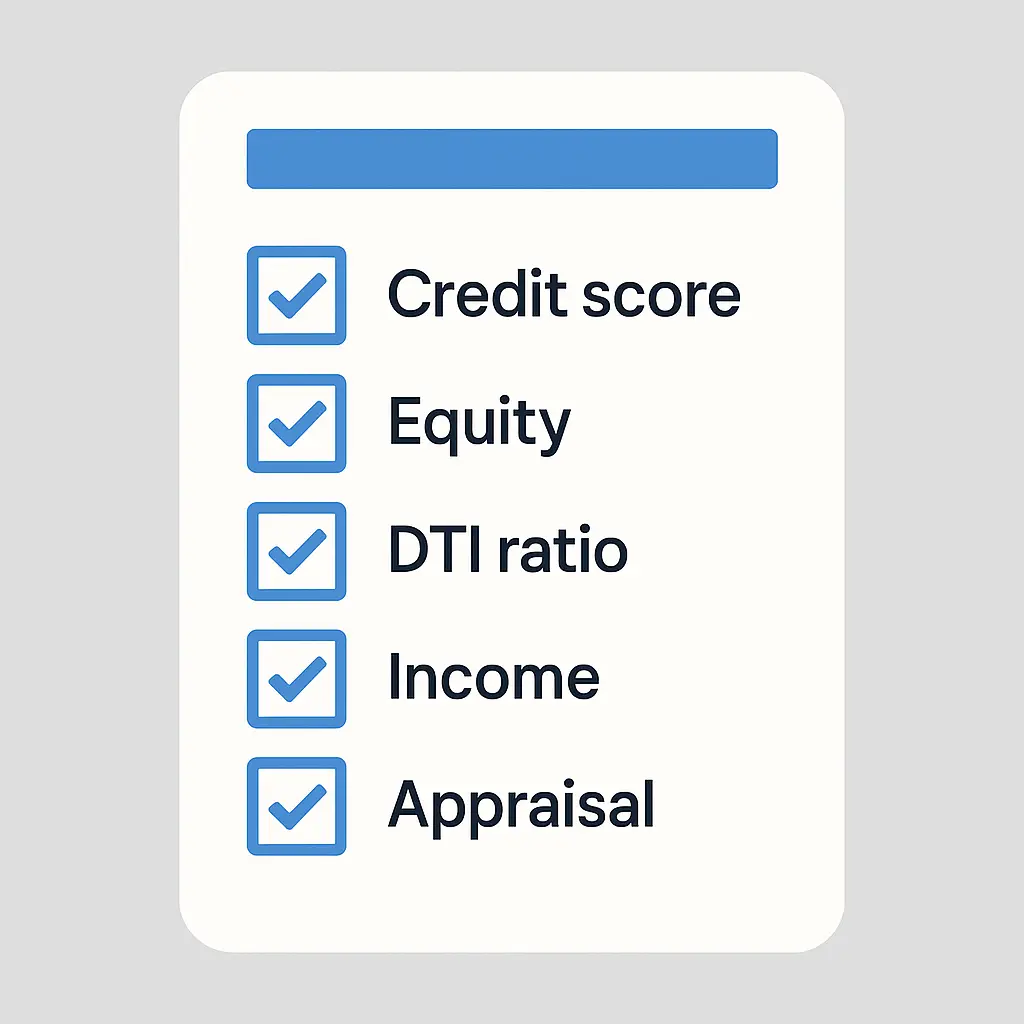

Step 3: They Factor In Your Credit, Income, and DTI

After the math checks out, lenders look at your credit score, income stability, and debt-to-income ratio (DTI) to see if you’re financially steady enough to handle a variable line of credit.

- A score above 680 usually keeps you in the approval zone.

- A DTI under 43% helps, too.

- Consistent income and on-time mortgage payments seal the deal.

It does the same math most banks do behind the scenes — but without the sales pitch.

Step 4: They Cap the Limit and Call It a “Credit Line”

Once everything checks out, the lender gives you a maximum credit limit and opens the line.

You can tap into it whenever you want — kind of like a financial safety net tied to your front door.

Just remember: the bank’s generosity isn’t charity. The higher your line, the more interest they can collect when you start using it.

The Two Phases Banks Don’t Explain Clearly

If you’ve made it this far, you already understand the basics of how a HELOC works.

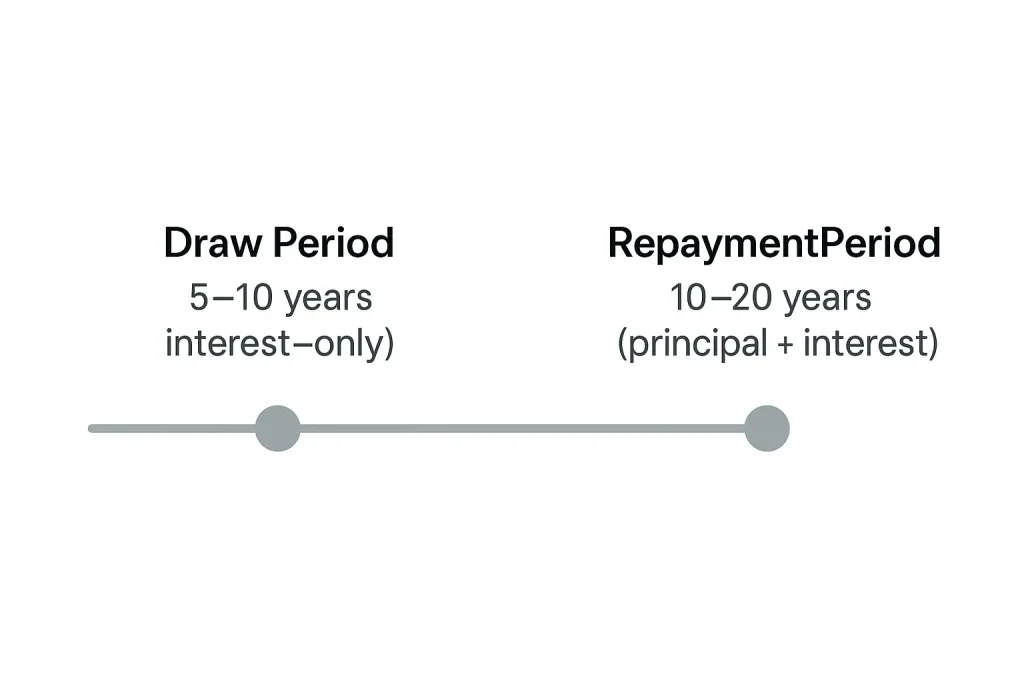

But here’s where the banks start using smoke and mirrors — the two phases of your HELOC:

the draw period and the repayment period.

They’ll toss those terms around like everyone’s supposed to know what they mean.

Spoiler: most people don’t.

Phase 1: The Draw Period (Usually 5–10 Years)

This is the fun part — or at least the part lenders make sound fun.

During the draw period, you can tap into your credit line whenever you need cash.

Need a new kitchen? Swipe.

Want to consolidate debt? Swipe.

Pay for a wedding or surprise roof repair? Swipe.

You can borrow, repay, and borrow again — just like a credit card.

Here’s the catch:

Most banks only require interest-only payments during this phase.

That sounds great at first… until you realize you’re not paying down the principal at all.

💬 Example: Borrow $40,000 at 9% interest, and your monthly payment might only be around $300.

Sounds manageable — but 10 years later, you still owe the full $40,000.

And because most HELOCs have variable interest rates, your payment can swing up or down depending on the market.

That’s why lenders want borrowers who look solid on paper — strong credit, consistent income, and reasonable debt levels.

Phase 2: The Repayment Period (Usually 10–20 Years)

Once the draw period ends, the lender shuts off the “easy money” faucet.

You can’t borrow any more — now it’s time to pay back what you owe.

And here’s the shocker most people don’t see coming:

Your payments often double or triple overnight.

Why?

Because now you’re paying both principal and interest — and that 10-year interest-only period didn’t make a dent in the balance.

🧾 Example: If your $40,000 balance carries into a 15-year repayment term, your payment could jump from $300 to $500-$600 a month.

Some lenders soften the blow with fixed-rate conversion options or blended repayment plans, but that’s not guaranteed.

The key is understanding your terms before you sign — because once this phase starts, you can’t go back.

A HELOC gives you flexibility, but it also comes with a timeline — and a timer.

Borrow smart, track what you use, and plan ahead for the repayment phase before it sneaks up on you.

HELOC Interest Rates Explained

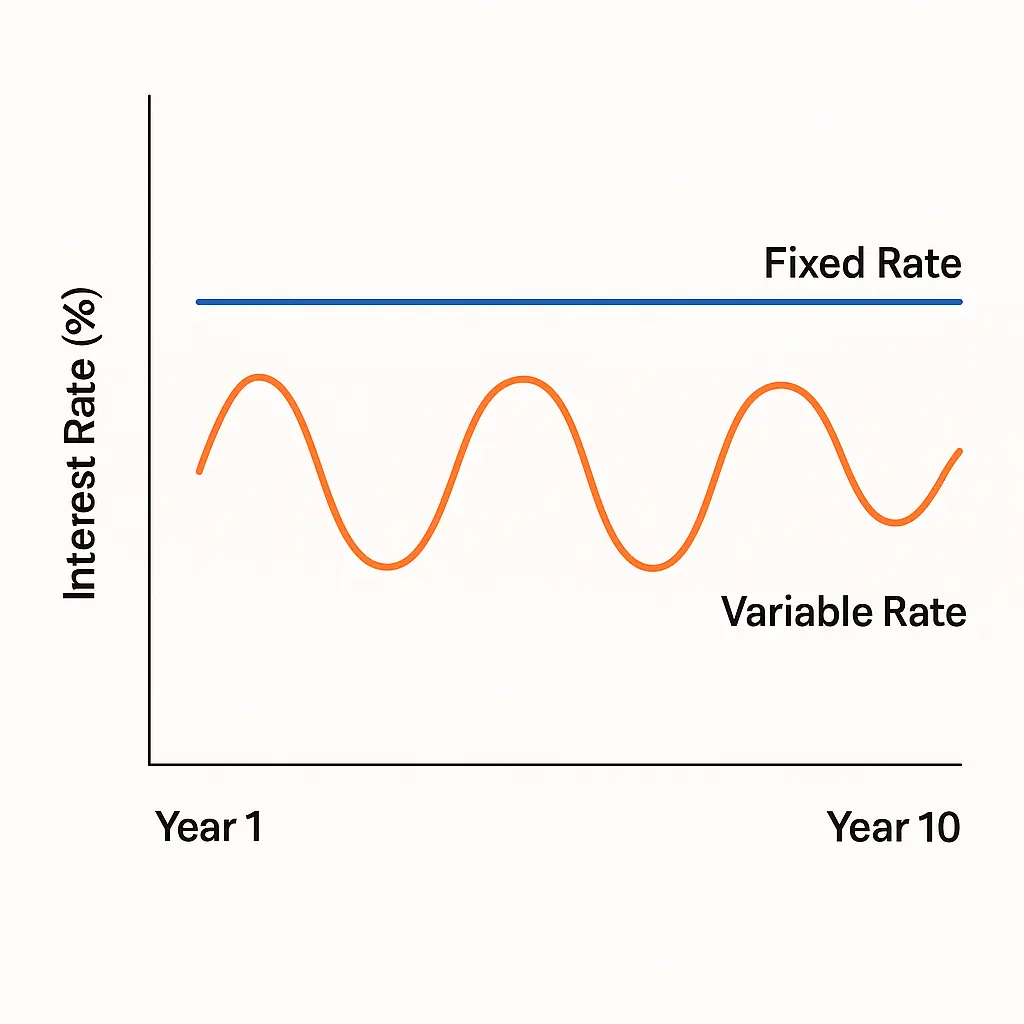

| Category | Fixed HELOC Rate | Variable HELOC Rate |

| Stability | Predictable payment | Can fluctuate over time |

| Cost | Usually has a higher rate | Typically lower initially |

| Flexibility | No change in rate | Could increase or decrease |

If you’ve ever wondered why your HELOC rate seems to change faster than gas prices, you’re not crazy.

That’s because most HELOCs have variable interest rates — which means they rise and fall based on something called the prime rate.

The “Prime Rate + Margin” Formula

Every HELOC rate starts with a simple equation:

HELOC Rate = Prime Rate + Margin

The prime rate is basically the rate banks charge their most creditworthy customers — it moves whenever the Federal Reserve adjusts rates.

Your margin is what the lender adds on top, usually between 0.5% and 3%, depending on your credit score, income, and debt-to-income ratio.

So if the prime rate is 8.5% and your margin is 1.25%, your HELOC interest rate becomes 9.75%.

That rate can change monthly or quarterly depending on your loan terms, which is why those “too good to be true” teaser rates always come with fine print.

Fixed vs. Variable: The Hidden Trade-Off

Banks love to push variable rates because they’re profitable — and let’s be honest, unpredictable rates scare people less when they’re buried in paperwork.

But here’s the thing:

Some lenders offer fixed-rate HELOC options or allow you to lock in a portion of your balance at a fixed rate once you’ve borrowed it.

That move can save you thousands in the long run, especially if you’re using the HELOC for something like a home renovation or debt consolidation, where you know the cost upfront.

How Interest Works in Real Life

This is the part banks love to skip over.

With a HELOC, you only pay interest on what you actually borrow, not your total line of credit.

Example:

Let’s say you have a $75,000 HELOC limit.

If you only draw $10,000 for a bathroom remodel, you’re only charged interest on that $10,000.

Pay it off, and your available balance resets.

That’s why HELOCs are powerful tools for flexible financing — but also dangerous if you don’t track how much you’re tapping into over time.

Pro Tip

If you ever notice your HELOC statement showing a higher rate than you remember, it’s likely because the prime rate changed — not because your lender secretly bumped your margin.

You can always check the Federal Reserve’s published prime rate to see exactly where your rate is coming from.

What You Can Actually Use a HELOC For

Most banks will tell you a HELOC is a flexible way to access your home’s equity — but they rarely explain what that actually means.

A HELOC can be used for almost anything. But that doesn’t mean you should use it for everything.

The Smart Uses

Let’s start with the practical and financially smart reasons to tap into your HELOC.

1. Home Improvements

This is the most common use, and for good reason. Using a HELOC to remodel your kitchen, replace your roof, or add an extra bathroom can directly increase your home’s value.

And since the IRS only allows you to deduct HELOC interest on funds used for “substantial improvements” to your primary home, this is the one scenario where it can even help at tax time.

2. Debt Consolidation

If you’re juggling high-interest credit cards, a HELOC can be a lifesaver.

By paying off credit card debt with a lower-rate HELOC, you can simplify payments and save serious money in interest, as long as you don’t run those cards back up again.

3. Emergency Cushion

A HELOC can function like a built-in safety net.

You don’t have to use it, but knowing it’s there can provide peace of mind during job loss, medical bills, or other unexpected expense.

4. Funding Big Life Expenses

Some homeowners use HELOCs for college tuition, weddings, or starting a business.

Just remember — every dollar borrowed is secured by your home.

That means if your “business idea” doesn’t work out, the lender doesn’t care. They’ll still expect payment.

The Risky or Not-So-Smart Uses

This is where people get into trouble.

Using a HELOC for vacations, new vehicles, or everyday spending defeats the purpose.

You’re turning short-term pleasures into long-term debt — debt that’s literally tied to your home.

Once that line of credit opens, it’s tempting to use it like free money. But it’s not.

It’s a tool that rewards discipline and punishes carelessness.

The Bottom Line

A HELOC can be a powerful financial lever when used strategically.

It can grow your home’s value, reduce high-interest debt, or serve as a financial buffer during uncertain times.

But the moment you start treating it like an extra paycheck, you’ve crossed into dangerous territory.

The Pros and Cons You’ll Never Hear From the Banker

Every banker loves to talk about how flexible and convenient a HELOC is.

They’ll throw around words like “access,” “freedom,” and “financial flexibility.”

But let’s be honest — they’re not exactly lining up to tell you what happens when rates climb, your payment doubles, or your home value drops.

Here’s what you actually need to know before you pull the trigger.

The Real Advantages

A HELOC can be a smart financial tool — when it’s used intentionally.

Here’s where it shines:

| Pros | Why It Matters |

| Flexible Access to Cash | You can borrow what you need, when you need it — no lump sum required. |

| Lower Interest Rates | Usually cheaper than personal loans or credit cards. |

| Interest May Be Tax-Deductible | Only if you use it for home improvements (see IRS Publication 936). |

| Revolving Line of Credit | As you repay, funds become available again — perfect for ongoing projects. |

| Can Increase Home Value | Smart renovations can boost equity long-term. |

The Hidden Downsides

This is the part that never makes it into the glossy brochure.

| Cons | What to Watch Out For |

| Variable Rates = Unpredictable Payments | If the Fed raises rates, your monthly payment goes up. Simple as that. |

| Your Home Is Collateral | Miss payments and you could face foreclosure — even for small balances. |

| Temptation to Overspend | It’s easy to treat a HELOC like a safety net and end up in deeper debt. |

| Closing Costs and Fees | Some lenders charge origination fees, annual fees, or appraisal costs. |

| Payment Shock Later | After the draw period ends, payments often double or triple overnight. |

The Honest Takeaway

A HELOC isn’t “good” or “bad.”

It’s a financial tool — and like any tool, it depends on how you use it.

Used wisely, it can lower your borrowing costs and help you build wealth.

Used carelessly, it can wipe out years of equity you worked hard to build.

The difference comes down to one thing: discipline.

How to Qualify for a HELOC

Getting approved for a HELOC isn’t as simple as walking into a bank and asking for one.

Even if you’ve built solid equity, lenders still want proof that you can handle another line of credit — especially one secured by your home.

The good news? The qualifications aren’t mysterious. Once you understand what lenders look for, you can position yourself like an easy “yes.”

Step 1: Build Enough Home Equity

The foundation of every HELOC is the amount of equity you’ve built.

Most lenders want you to keep at least 15–20% equity in your home after the HELOC is added.

So, if your home is worth $400,000 and your mortgage balance is $300,000, you have 25% equity.

That’s usually enough to qualify — but if your mortgage balance is closer to $340,000, you may not meet the threshold.

Step 2: Maintain a Strong Credit Score

Lenders want to see a history of responsible borrowing.

A credit score of 680 or higher usually lands you in the “safe zone,” while 700+ can unlock better rates and higher credit limits.

If your score is under 680, you might still qualify — but expect a smaller line and a higher rate.

Step 3: Keep Your Debt-to-Income Ratio in Check

Your debt-to-income ratio (DTI) shows lenders how much of your monthly income already goes toward debt payments.

Most want to see this number below 43% — though some will stretch it for borrowers with excellent credit or high income.

If your DTI is creeping up, paying down credit cards or car loans before applying can make a noticeable difference.

Step 4: Show Stable Income and Employment

Banks want reassurance that you can repay the line of credit — even if interest rates rise.

They’ll verify your job, income history, and possibly your tax returns if you’re self-employed.

If you’ve recently changed jobs or started freelancing, that’s not a dealbreaker — just be ready to show consistent income deposits over the last 12–24 months.

Step 5: Prepare for an Appraisal

Most HELOC lenders will require a home appraisal to confirm your property’s current value.

This protects them (and you) from borrowing more than your home is worth.

Some lenders now use automated valuation models (AVMs) instead of full appraisals, but that depends on your location and loan amount.

What Happens If You Sell or Refinance While Having a HELOC

Here’s something most homeowners don’t realize until they’re already sitting at the closing table — you can’t sell or refinance your home without paying off your HELOC first.

That’s because your HELOC acts as a second lien on your property.

Until that balance is cleared, your home technically has two loans tied to it — your primary mortgage and your HELOC.

Selling Your Home

If you sell your house while your HELOC is open, your lender will require that line to be paid off in full before the sale is complete.

The closing agent or title company will handle this automatically — the payoff comes directly out of your sale proceeds, just like your first mortgage.

Once the HELOC is paid, the lender files a lien release with the county to remove their claim on your property.

This process usually happens within a few business days after closing.

If your HELOC balance is small or you haven’t drawn any funds, the payoff is simple — but if you’ve used a large portion of your line, it will reduce how much cash you walk away with after the sale.

Refinancing Your Mortgage

Refinancing while you have a HELOC is trickier.

Since your HELOC sits behind your primary mortgage, your current HELOC lender has to “subordinate” their lien… meaning they agree to stay in second position after the new mortgage is recorded.

Some lenders do this automatically. Others will require a formal subordination request, updated credit check, and sometimes even an appraisal.

If they refuse, you may have to pay off and close the HELOC before your refinance can move forward.

Closing a HELOC Early

If you decide to close your HELOC on your own (even without selling or refinancing), just know that some lenders charge early termination fees — especially if you close it within the first few years.

Always check your loan agreement for details before pulling the plug.

Closing the line doesn’t hurt your credit by itself, but if you had a large unused credit limit, your overall credit utilization ratio could increase slightly.

That’s temporary — and it usually evens out after a few months.

The Bottom Line

If you’re planning to sell or refinance, give your HELOC lender a heads-up early in the process.

That way, they can prepare payoff paperwork and lien release documents before closing — saving you time and potential headaches.

Example Scenario (Walkthrough)

By now, you’ve seen how a HELOC is structured — but sometimes the easiest way to understand how a HELOC works is to see it play out with real numbers.

Let’s walk through what it looks like from start to finish.

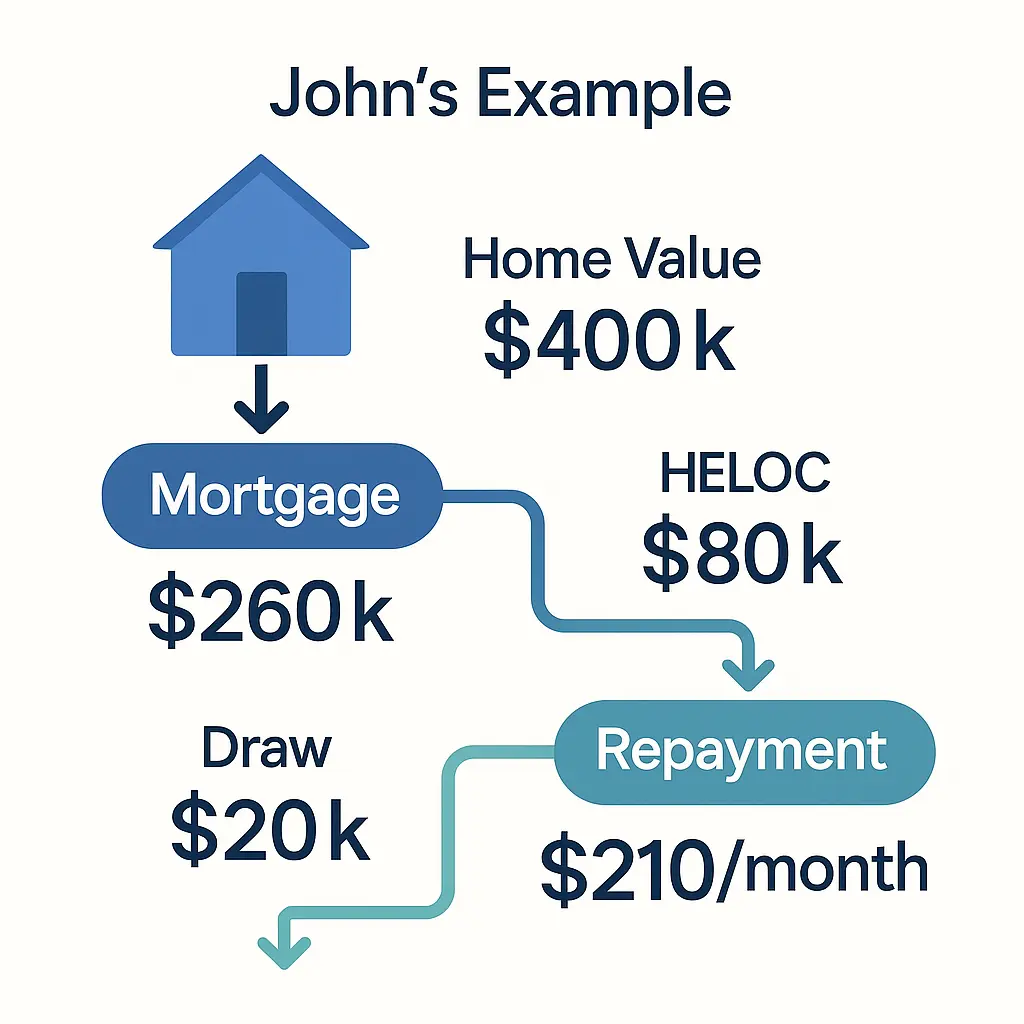

Meet John

John owns a home worth $400,000 and still owes $260,000 on his mortgage.

That means he has $140,000 in equity built up.

His lender allows up to 85% combined loan-to-value (CLTV).

So here’s the math:

$400,000 x 0.85 = $340,000 (maximum combined debt allowed)

$340,000 – $260,000 = $80,000 potential HELOC limit

The bank approves John for an $80,000 HELOC.

Draw Period: The Spending Years

For the first 10 years, John can borrow and repay freely — this is his draw period.

He decides to use $20,000 to remodel his kitchen.

His HELOC rate starts at 9% (prime rate + margin), and his lender only requires interest-only payments during the draw period.

So his monthly payment looks like this:

$20,000 x 0.09 = $1,800 per year

$1,800 ÷ 12 = $150 per month (interest-only)

Not bad. John loves his new kitchen and keeps the rest of his HELOC available for future projects.

The Surprise at Year 11

After 10 years, John’s draw period ends, and the repayment period begins.

He can’t borrow any more — now he has to pay back the $20,000 principal plus interest over the next 15 years.

His monthly payment suddenly jumps from $150 to around $210–$230 per month, depending on rate changes.

That’s not disastrous, but if John had borrowed more or if interest rates climbed, his payment could easily double.

Fast Forward: Selling the Home

A few years later, John sells his house for $450,000.

At closing, his first mortgage balance is $240,000 and his HELOC balance is $18,000.

Both are automatically paid off from the sale proceeds, leaving him with roughly $192,000 in cash before fees.

That’s how a HELOC works in practice — simple in theory, but full of moving parts once you start using it.

Key Takeaways

- You only pay interest on what you actually borrow.

- Payments stay low during the draw period but rise sharply during repayment.

- The line resets as you repay — giving you flexibility if used responsibly.

- When you sell or refinance, your HELOC must be paid off in full.

HELOC vs Home Equity Loan vs Cash-Out Refinance

Once people understand how a HELOC works, the next question almost always comes up:

“Is this the best way to access my home’s equity?”

The answer depends on your goal — flexibility, stability, or a full reset of your mortgage.

Here’s how the three main options stack up.

The Quick Comparison

| Feature | HELOC | Home Equity Loan | Cash-Out Refinance |

| Type of Loan | Revolving line of credit | Lump-sum second loan | New mortgage replacing the old one |

| Interest Rate | Variable (changes with prime rate) | Fixed | Fixed (new mortgage rate) |

| How You Receive Funds | Borrow as needed | One lump sum upfront | Lump sum when you refinance |

| Payments During Draw Period | Usually interest-only | Fixed monthly payments | Fixed monthly payments |

| When It Makes Sense | You need flexibility or want ongoing access to cash | You know the exact amount you need | You want to refinance your mortgage and pull out cash |

| Typical Term | 5–10 years draw + 10–20 years repay | 5–20 years | 15–30 years |

The Key Differences Explained

A HELOC gives you ongoing access to your home’s equity without touching your existing mortgage.

You can borrow, repay, and borrow again — perfect for projects or variable costs.

The trade-off is that the interest rate can change, and payments rise once the draw period ends.

A Home Equity Loan gives you a fixed lump sum with predictable payments — better for one-time expenses like a major renovation or paying off high-interest debt.

The downside? Once it’s spent, it’s gone. No revolving balance.

A Cash-Out Refinance replaces your existing mortgage with a new, larger one, and you pocket the difference in cash.

It can simplify things into a single payment, but you’ll restart your mortgage clock and pay new closing costs on the full amount.

Which One Saves You More?

Choosing between them comes down to your situation.

If you value flexibility and only need funds here and there, a HELOC is usually the winner.

If you prefer stability and fixed payments, the home equity loan might make more sense.

The Bottom Line

All three products let you tap into your home’s equity — they just do it in different ways.

There’s no universal “best” option. It’s about what fits your financial plan, risk tolerance, and timeline.

Yes. Most homeowners do. Your mortgage is the first lien; the HELOC sits behind it as a second lien against your home.

Only if the money is used for home improvements that add value to your property. You can verify details in the IRS Publication 936.

Technically yes, but it’s risky. Lenders don’t love it, and using your primary home as collateral for an investment purchase adds unnecessary leverage.

Slightly. It appears as a revolving credit line and can help your score if used responsibly, but large draws can increase your utilization ratio temporarily.

You can no longer borrow, and payments shift to include principal and interest — usually increasing your monthly cost.

The Smarter Way to Use Your Home’s Equity

Now that you understand how a HELOC works, the mystery’s gone.

It’s not some complicated financial trick, it’s a tool.

One that can help you leverage your home’s value without selling it, but only if you respect how it works.

Used wisely, a HELOC can fund renovations, eliminate high-interest debt, or give you a flexible safety net when life throws curveballs.

Used carelessly, it can quietly drain your equity and leave you owing more than you started with.

At the end of the day, banks profit from confusion.

You don’t have to.