Why The Advertised Cost Is Misleading

Most people who Google real estate license cost are expecting a single number. Something clean. Something contained. A few hundred dollars, maybe a thousand, and then they can decide if becoming an agent is worth it.

That expectation doesn’t come out of nowhere. Pre licensing schools are very good at advertising the cheapest possible entry point. Course fees. Exam fees. A tidy price tag that makes the whole thing feel approachable, low risk, and easy to justify. What rarely gets mentioned is that passing the exam is only the first step in learning how the business actually works, from generating leads to evaluating opportunities using the same real estate investing tools professionals rely on every day.

The problem is that the advertised number only answers one question. How much it costs to pass the test. It does not explain how much it costs to operate, market yourself, or build deal flow once you are licensed. And that gap is where most people get blindsided.

The Cost Everyone Expects (And Plans For)

When people look up real estate license cost, this is the part they are usually trying to price out. The obvious stuff. The line items that show up on pre licensing school websites and state licensing pages.

These costs feel manageable, which is exactly why most people stop their math here.

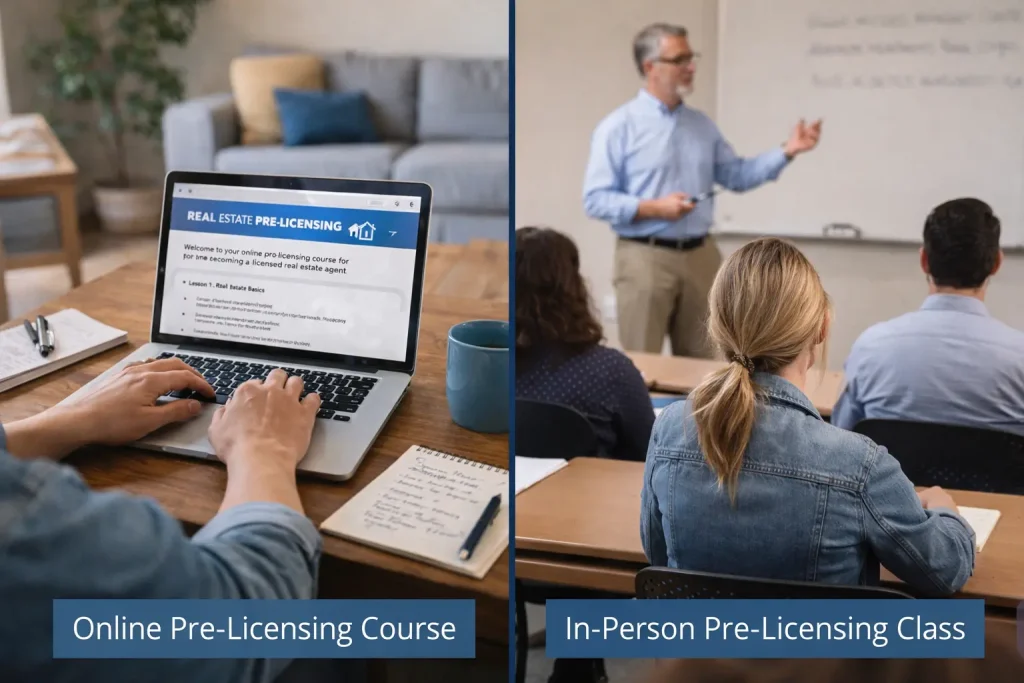

Pre-Licensing Education

Pre licensing education is usually the first expense people encounter, and it often sets the tone for how affordable the whole process feels. Depending on the state and format, courses typically range from a few hundred dollars on the low end to over a thousand for in person programs.

Online courses are usually cheaper and more flexible, which makes them appealing if you are working full time or testing the waters. In person classes tend to cost more but offer structure, accountability, and live instruction that some people prefer.

Required hours vary by state, sometimes dramatically. One state might require forty hours. Another might require well over a hundred. That difference alone can change both the price and the time commitment in ways people do not always anticipate upfront.

Cheaper courses often come with tradeoffs. Less instructor access. Slower response times. Fewer exam prep resources. For self motivated learners, this might be fine. For others, it can quietly stretch the timeline and add frustration.

Exam And Application Fees

Once the coursework is complete, there are still a few required fees before you are officially licensed. The state exam fee is usually paid separately and is non refundable, even if you do not pass the first time.

There is also the license application fee, which covers the state processing your paperwork and issuing your license number. This is another cost most people expect, even if they are not sure of the exact amount.

Fingerprinting and background checks are often the last surprise in this phase. These fees are usually modest, but they are required and paid out of pocket before anything moves forward.

“These are the costs everyone sees coming — and they’re only part of the picture.”

The Real Estate License Costs That Catch People Off Guard

This is where the math usually breaks. These are the costs almost no one sees in the ads, but nearly everyone runs into right after getting licensed. By the time they show up, the license already feels sunk, and backing out feels harder.

That is exactly why they matter.

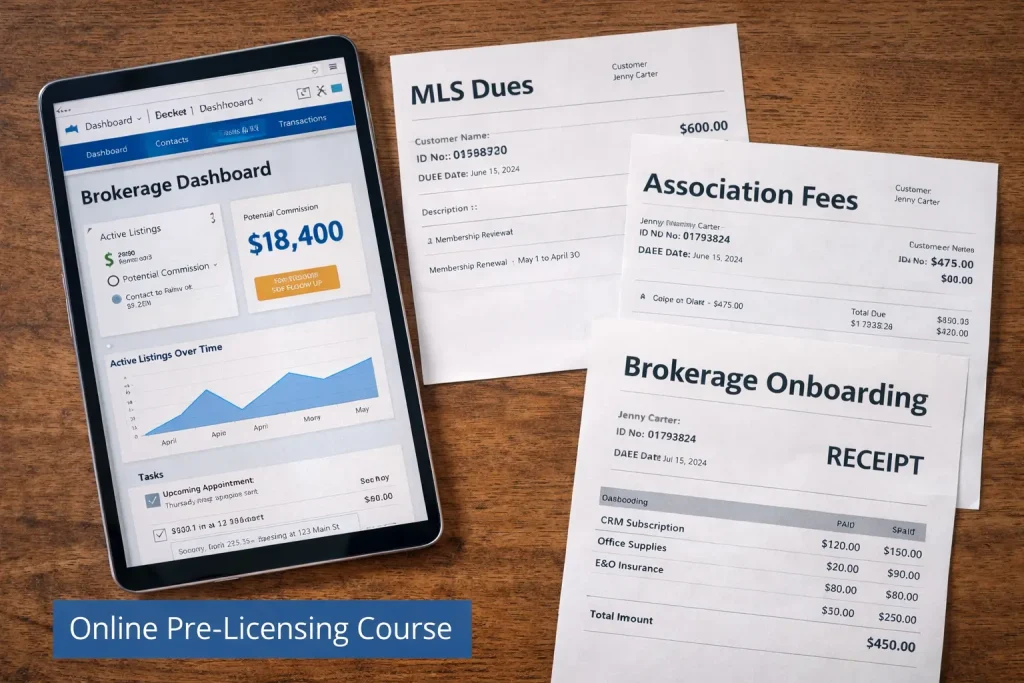

Broker Onboarding And Desk Fees

Most new agents assume that once they pass the exam, they can start working immediately. What they do not realize is that joining a brokerage almost always comes with its own costs.

Some brokerages charge a one time onboarding fee to cover training, systems access, and administrative setup. Others skip the upfront fee but require monthly desk or technology fees instead.

Even brokerages that advertise no desk fee often recover those costs elsewhere. Transaction fees. Technology bundles. Mandatory tools. The expense does not disappear. It just moves.

The key takeaway is simple. You are paying to operate under a brokerage, even if the pricing is not obvious at first glance.

MLS And Realtor Association Dues

Access to the MLS is not free, and it is not optional if you want to function as a full service agent. Local MLS fees are typically billed quarterly or annually and must be paid to access listings, comps, and market data.

On top of that, many agents are required or strongly encouraged to join local, state, and national Realtor associations. Each layer comes with its own dues.

The timing is what catches most people off guard. These fees are often due immediately or within your first few months, long before you have closed a deal or earned a commission.

Errors And Omissions Insurance

Errors and omissions insurance exists to protect you if a client claims you made a professional mistake. Some brokerages include this coverage. Others require you to purchase it separately.

Depending on the structure, you may pay monthly or annually. Either way, it is an ongoing cost tied directly to maintaining your license.

New agents tend to underestimate this expense because it feels abstract until it is required. But once you are licensed, it becomes part of the baseline cost of staying in the business.

Ongoing Annual Costs Most People Don’t Budget For

This is the point where thinking in terms of license cost stops being useful. Once you are active, the real question becomes how much it costs each year to stay operational. These expenses are not optional, and they do not pause just because business is slow.

If you do not plan for them, they quietly drain cash in the background.

License Renewal And Continuing Education

Real estate licenses do not last forever. Renewal cycles are set by the state, usually every one or two years, and missing a deadline can mean late fees or even a lapse in your license.

Continuing education is part of that renewal. CE courses are required to stay compliant, and while individual classes are not usually expensive, they add up over time. Especially when you factor in exam prep, platform fees, or specialty courses.

There is also a time cost that rarely gets acknowledged. Hours spent completing CE are hours not spent prospecting, showing homes, or following up with clients. That opportunity cost matters, especially early on.

Technology And Tools

Most agents rely on a stack of tools to stay organized and responsive. CRM systems help track leads and conversations. Transaction management software keeps deals compliant and on schedule.

E signature platforms, email tools, and basic websites are often treated as essentials, not luxuries. Some are bundled through a brokerage. Others are paid separately.

Even when these tools are relatively inexpensive on their own, the combined monthly or annual total becomes a fixed operating expense you carry regardless of income.

Marketing And Lead Generation

This is where costs start to scale with ambition. Business cards, yard signs, and lockboxes are baseline expenses that show up early and repeat often.

Paid leads, digital ads, and geographic farming add another layer. They are not required to get started, but they are often necessary to grow.

Many new agents assume their brokerage will provide enough free leads to build momentum. In practice, those leads rarely scale. At some point, you either invest in your own lead generation or accept slower growth.

The Hidden Cost Nobody Talks About… Time

Time is the most underestimated part of the real estate license cost, and it is rarely mentioned in the same sentence as fees or dues. But for most new agents, it ends up being the most expensive component of all.

You can plan for money. Time has a way of slipping past quietly.

Time Before First Commission

There is almost always a gap between getting licensed and getting paid. For some agents it is a few weeks. For many, it is several months. That delay is normal, even if no one warns you about it upfront.

During that window, you are still working. Showing homes. Hosting open houses. Sitting in training sessions. Learning contracts. Following up with leads that do not convert.

All of that effort is unpaid. It has to be, because commissions only arrive at the closing table. Until then, time is your primary investment.

Irregular Income In Year One

Year one income is rarely smooth. Expenses show up on schedule, but commissions do not. You might go months with nothing, then receive a lump sum that has to carry you forward.

This mismatch is where people get caught. Bills do not care that your pipeline is growing. MLS dues, insurance, and technology fees still need to be paid.

Cash reserves matter more than most people think because they buy you time. Time to learn. Time to make mistakes. Time to build momentum without being forced out by short term pressure.

What The Real Estate License Actually Costs In Year One

By the time you add everything up, the real estate license cost looks very different than it did at the beginning. This is where clarity finally replaces guesswork. Not with a single number, but with realistic ranges based on how you plan to operate.

The mistake is assuming there is one right answer.

Low-End Vs Realistic First-Year Cost Ranges

At the bare minimum, a new agent can keep costs low by choosing inexpensive pre licensing education, joining a lean brokerage, and avoiding paid marketing. This approach reduces cash outflow, but it often slows momentum and extends the time to first commission.

A more typical new agent scenario includes standard brokerage fees, MLS and association dues, basic technology tools, and modest marketing spend. This is where most people land, whether they plan to or not.

An aggressive growth scenario pushes costs higher. Paid leads, advertising, premium tools, and additional training can accelerate experience and visibility, but they require upfront capital and tolerance for risk.

Each path is valid. The difference is awareness.

Why Cheap To Get Licensed Does Not Mean Cheap To Become An Agent

Getting licensed is the entry fee. It proves you are legally allowed to participate. It does not equip you to operate.

Operating is the real investment. It includes time, systems, marketing, education, and the ability to absorb slow periods without panicking.

When people underestimate the cost of becoming an agent, it is rarely because they missed a fee. It is because they misunderstood the commitment. Understanding that distinction early changes everything.

Is The Real Estate License Cost Worth It?

Whether the real estate license cost is worth it depends less on the number and more on the context. The same expenses can be a smart investment for one person and a financial mistake for another.

The difference comes down to expectations and preparation.

When The Cost Makes Sense

The cost makes sense when you are approaching real estate with a long term mindset. This is not about quick wins. It is about building skill, reputation, and consistency over time.

It also makes sense if you have the ability to absorb slow months without panic. Early income gaps are normal, and having breathing room allows you to focus on learning instead of chasing desperate deals.

Finally, it makes sense when you are willing to invest in systems. Skills can be learned, but tools and structure support execution. Agents who plan for this tend to last longer.

When It Doesn’t

The cost rarely makes sense for people expecting quick money. Real estate does not reward urgency. It rewards patience and follow through.

It also breaks down when there is no financial runway. Without reserves, every slow week feels catastrophic, and that pressure leads to poor decisions.

Treating real estate like a casual side hustle is another red flag. The expenses are real whether your effort is part time or full time. If the commitment is not there, the return usually is not either.

Budget For The Career, Not Just The License

The way most people think about the real estate license cost is backwards. They focus on the test, the course, and the minimum amount required to get approved. That framing makes the decision feel smaller than it really is.

A better way to think about it is as a business decision, not a licensing decision. The license simply gives you permission to play. Everything that follows determines whether you can stay in the game.

Before moving forward, it is worth slowing down and running real numbers. Calculate your total first year costs, including fees, tools, insurance, and the months where income may be zero. Then compare that against realistic income expectations, not best case scenarios or highlight reels.

This shift in perspective changes outcomes. Most people do not fail because they cannot pass the exam. They fail because they under budget the reality of what it takes to operate.